A lot of confusion already exists around which type of technological leader a bank needs (Chief Technology Officer? Chief Information Officer?) and now we’ve seen the advent of an even newer role to consider: a Chief Digital Officer. So, what is a Chief Digital Officer? And is this the right role to install at your bank? Let’s first define these roles in a bit more detail to help you determine what may be best for your institution.

Chief Technical Officer (CTO) – Will establish company technology vision, strategies, and plans for growth. They will supervise the system and quality assurance processes. Looks at future technology and its’ potential impact on the organization and industry. A true CTO is a technologist at the base layer of technology and might be a better resource for organizations that have a forward-thinking R&D function or are building solutions from the ground up. Even large banks do not have a true R&D function, and a “real” CTO might not even feel challenged inside of a financial institution.

Chief Information Officer (CIO) – Responsible for overseeing a company’s IT needs, which includes managing and implementing technology to support the organization’s goals. Looks at current technology and ensures its’ reliability for users. A CIO is a better solution for a bank for a smaller entity trying to adapt and enhance or shake legacy complications.

Chief Digital Officer (CDO) – Overall responsibility is to drive growth and strategic renewal by transforming an organization’s traditional analog business into digital ones. Looks at solutions to improve the customer journey across the enterprise.

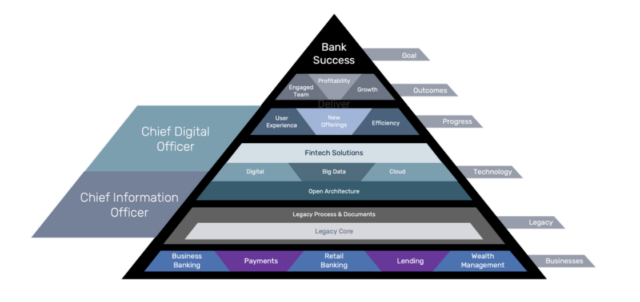

CDO vs CIO – Plain and simple, the key is to focus on your technology-to-solution stack. The below Bank Success pyramid helps us understand how an organization’s CDO and CIO play off one another.

- Skill #1: Storytelling

- How to convey the before and after of a new digital solution. Remember, no one wants the tool… they want the outcome.

- Skill #2: Innovation

- Apply the best tools in a new and innovative way and innovating your business models.

- Skill #3: Understand new trends and products in technology

- This doesn’t require a Computer Science degree, just the ability to put trends in context for the bank, with the bank’s desired future state at the heart of it.

- Skill #4: Execution

- Having a roadmap of cool new solutions that never roll out to the bank’s customers is useless. “Digital Thought Leaders” need to also actually deliver the innovation envisioned by the bank.

- Skill #5: Be Influential

- This is a key, as many people in the bank will resist the new digital systems (humans fear change) and even more so when it might impact their jobs directly. Bank employees can feel threatened by new digital solutions and will need to be successfully “sold” on the benefit of the new systems.

Most CIOs do not have these five skills, as the CIO skillset tends to be more pragmatic and IT-focused. It is easiest to think of a CIO as the manager of current technology, which is a very important, even critical task. A CDO is more focused on moving the bank from current state to future state… Digital.

Does Your Bank Need a CDO Today?

If your institution is operating a traditional core and is between $250M and $3B in assets, a CDO may not be a pivotal hire. In this size of bank, it may be counter-productive, as a super-innovative, future-thinking digital pro might end up feeling isolated and powerless. Giving a person the C-title without a team, a budget and a clear mandate leaves that over-qualified individual seeming like a “lone wolf” against everyone at the bank. This usually ends with them leaving prematurely, with nothing really getting done.You can easily outsource the move to digital at this point, until your bank is far enough along on the modernization journey to warrant a full-time in-house resource. Consider that the advantage of an external resource at this point in your journey is three-fold:

- It won’t be an FTE who becomes a permanent cost to the bank.

- Will come with a clear, objective view of your bank, with the history and industry knowledge of other banks and their digital offerings.

- Will have an unbiased view of solutions by being exposed to a variety of providers and influencers.

Key takeaway: Every institution needs a trusted Chief Digital Officer, whether internal or external, to assist in the development and execution of a digital roadmap. Scaling this digital mountain, collaboratively, will ensure that the institution has a bright future… a digital future.Dion Lisle is the Managing Partner of Forty Grand, a Fintech advisory firm that helps community banks drive value through digital transformation and innovation. Please feel free to contact him at dion@forty-grand.com and visit their website at www.fortygrand.co.

Travillian’s Banking and FinTech Practice provides Search and Talent Advisory services to depository institutions across the country. Established in 1998, the firm has built a unique platform that touches every corner of the industry. To learn more, click here, or get in touch below!

|

Brian Love, Head of Banking & Fintech

(484) 680-6950 | blove@travilliangroup.com |