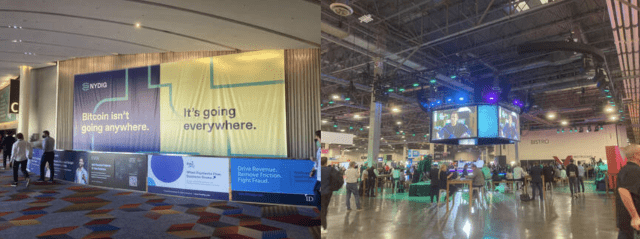

I am in Las Vegas for Money20/20, one of the largest fintech/banking conferences in the world. After 18 months of shutdowns, Zoom calls, remote work, and minimal traveling, it feels greats to be meeting people in person again. The stats for Money20/20 are astounding:

- 300+ Speakers

- 8,000+ Registrants

- 2,300 Companies

- 25% Executive & Board Level

I was a rookie this year, so I spoke with many people about what to expect, but as with everything in life, experience is the only way. To say I was impressed was an understatement. I was blown away by the size and scope of the event. From the speakers to booths, the electric atmosphere of anticipation around every corner, it was Disney World for fintech/banking fans. For me, there was an energy of innovation and optimism in the air.

Companies and firms sharing a real mission to improve the financial lives of people, and banks looking for new ways to reach their customers.

I think Magic Johnson said it best in his keynote speech on Sunday night “I believe you can do well and do good at the same time. True success is making others successful.” That is a point guard’s mentality and you can feel the entire fintech industry working from the perspective of the consumer.

Some Takeaways:

- Banks seem more open than ever for fintech partnerships. I think Covid was such a colossal game changer that banks now understand the urgency of action before it is too late.

- BaaS banks are in short supply for the massive amount of fintechs looking to partner for their products. Firms such as Synctera and Treasury Prime are helping to alleviate this backlog, but banks such as our clients – Coastal Community and Lincoln Savings – are in a prime position to be picky when choosing partners to onboard to their BaaS platform.

- Digital Assets, Blockchain, Defi, Bitcoin, Crypo, & NFT’s were everywhere – our client NYDIG had a big presence.

- There was plenty of interest around Regtech, Compliance, and Risk. From biometric identity to AI, in a risk adverse industry these new technologies are crucial. Banks will likely be focusing on bringing new talent in to strengthen and refine these areas going forward.

Post Vegas, I spoke with my friend Scarlett Sieber, Chief Strategy & Growth Officer for Money20/20. A few takeaways and behind-the-curtain insights included:

- A few years ago, the number of speakers at Money20/20 was 900 with 8 stages. In 2019 there were 600 speakers with 5 stages and then in 2021 330 speakers with 4 stages. This is intentional. Money20/20 wants to keep the content relevant and fresh showcasing unique voices and conversations you probably will not hear at other conferences.

- The Money20/20 App & Connections Lounge were a huge success – In Europe there were 1,500 meetings via app in 2019 & 7,000 this year. The numbers in Vegas were similar.

- What’s next? How can Money20/20 provide more suggested connections at the conference via technology and the app? (i.e if a crypto fintech CEO was looking for BaaS or compliance partners, Money20/20 could help facilitate those connections.)

- Trends and conversations in Vegas? From a bank’s perspective, there were discussions about crypto and BNPL. Financial inclusion was quite large and Regtech was a focus. Platforms came in strong, with inquisitive- What is this “as-a-service” Banking, Credit Cards and Lending?

- Scarlett hopes Money20/20 can connect within communities in meaningful ways outside of the conference circuit. Is there a way to balance digital with smaller scale in-person events, and can there be a foundational, fundamental role in the future that impacts the direction of the industry as a whole?

Travillian’s Banking and FinTech Practice provides Search and Talent Advisory services to depository institutions across the country. Established in 1998, the firm has built a unique platform that touches every corner of the industry. To learn more, click here, or get in touch below!

|

Keith Daly, Principal -Banking & Fintech Search

(610) 908-5968 | kdaly@travilliangroup.com |