We will begin with a picture: The Fed Funds rate has been zero for two years, and prior to that about 8 years.

In this rising rate backdrop there are two reasons banks may perform well vs the broader market. Specifically,

- Bank EPS tends to do better than the broader market as margins expand. Most readers know this. The angle is….

- The broader market has begun from a more expensive level and can show more multiple contraction than banks as rates rise. In other words, the market had gotten so expensive that its headliners – firms like Adobe or Apple, trade like a bond, and that is a precarious position with rising rates. Banks were never so expensive.

Let’s dig in briefly to each of these points:

- Bank EPS growth outperforms the market with higher rates, especially for certain sub-classes of banks.

This is a function of banks with checking accounts making loans against 0% deposits, and rolling over securities at higher rates. As always there is nuance. Large banks tend to hedge. Many banks are CD-funded or invest in long mortgages. For this reason, margin expansion Is often over-estimated, but varies significantly by bank. For example from 2016 to 2018, the last rising rate period, rates rose over 2% but the margin across banks rose from only 3.1% to 3.4%. The margin for credit card lenders somehow managed to fall! For mortgage lenders it rose modestly, from 2.84% to 2.97%. For consumer lenders it ripped higher, from 3.44% to 4.34%.

We may find outsized margin expansion is in the banks with significant excess cash, like JP Morgan whose margin has fallen from 2.55% in 2019 to 1.6% today, or in many of the fintech-oriented banks with 40-60% sustainable funding at near 0%

A final note – in our view analysts have only begun to raise estimates to account for recent rate changes.

(https://www.fdic.gov/analysis/quarterly-banking-profile/statistics-at-a-glance/)

- Large non-financial companies are valued a bit like bonds. Their multiples are at risk to retract closer to where the banks trade.

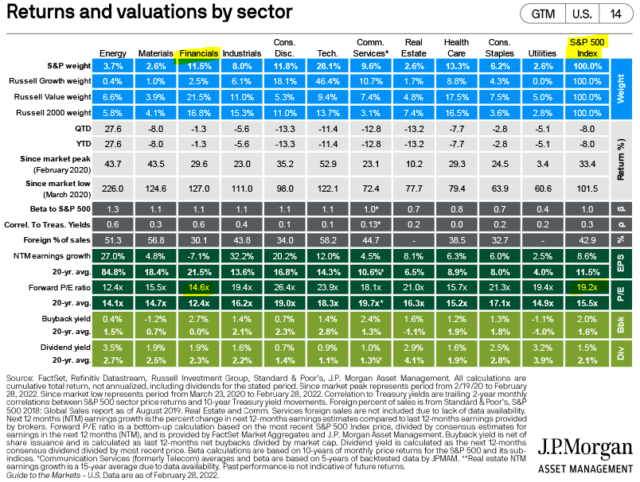

Start with financials trading at a range of 70% of the broader market. Only energy is cheaper, as shown below courtesy of JP Morgan’s Guide to the Markets. If you winnow down to the banks we like, that discount is even cheaper, to be 50-60%. That comes despite growth opportunities in many cases preferable to the broader financials sector (Data are recent month end and vary slight to today with broader market multiple back above 20).

Put a different way, financial stocks are offering about a 7% return, or earnings yield. (1/14 – the P/E = 7%)

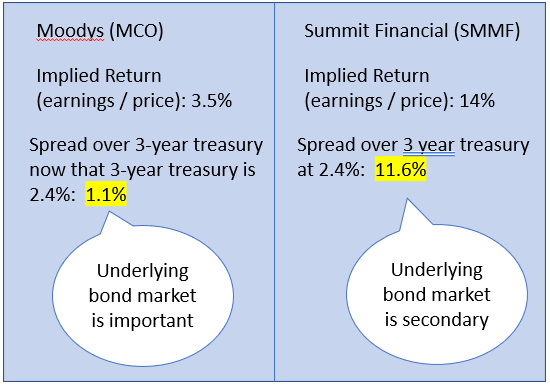

This rises to 7-14% for banks, depending on where you look. Little banks like Summit of West Virginia (SMMF) trading at 7.5x or Northrim (NRIM) in Alaska at 9x are on the upper end.

Here is a picture to describe this arrangement:

As this has played out over the past six months, you can see that the boring West Virginia bank was generating alluring performance relative to the bond-like market favorite, Moodys.

Maybe Moodys will grow faster than Summit, but Moodys revenue shrank in 3Q21 and 4Q21 relative to the second quarter of 2021.

In this context you can see why bank investors have an advantage with rising rates…not just from earnings but also from valuations. This occurs from legacy models such as Summit or certain more technology-oriented banks such as Communities First (CFST), among many others.

In summary, bank sector investors may wish to be patient and let this play out. For those prioritizing fintech or S&P 500 favorites…the bar remains high.

About Colarion: Colarion is a diverse investment advisor, with expertise in the financial services sector. The firm manages both separate accounts and a pooled sector fund. For additional detail you may contact us below or see: http://www.colarionpartners.com.