Pre-COVID, the bank sector was ripe for consolidation.

I remember thinking heading into this year that it was likely to be an active one for M&A, for a variety of reasons.

- First, there were notable fundamental challenges. Interest rates were heading lower, pressuring margins; loan growth was likely to remain muted given late cycle credit concerns; and increased technology spend – on infrastructure and talent — was a certainty, amidst encroachment from fintech and market share gains by the big banks. Thus, cost takeouts via M&A were among the few fundamental levers available to be pulled to help drive earnings growth in the coming years.

- Second, there were the typical and ongoing succession issues in the C-suite and in boardrooms at many banks across the country, which has long been a catalyst for bank sector consolidation.

- Third, following the longest economic expansion on record, the perception was that at some point, a downturn was inevitable, which would likely lead many to conclude that an exit now was preferable to waiting out a recession of unknown length and severity.

This year’s events resulted in a pause, but likely only temporarily.

The COVID-induced downturn has brought most M&A activity that had been contemplated for this year to a near-standstill. However, this year’s developments are likely to only further and accelerate the M&A trend over the intermediate and longer-term. Fundamental challenges are now deeper and likely to be longer-lasting than what was contemplated a year ago at this time. Interest rates have declined significantly, and spreads are further compressed; loan demand is virtually non-existent; the pandemic has accelerated the race to digital adoption, and in the process, highlighted a vast and likely near-insurmountable gulf between the technological “haves” and “have nots”; and succession issues have likely never been more pressing of a concern. It also seems clear through anecdotal conversations that discussions that had been taking place pre-COVID were merely shelved for now, and not completely terminated, resulting in a backlog of deals when talks eventually resume (if they have not already).

Industry experts on a recent webinar hosted by Travillian opined on the likely road ahead.

Last week, The Travillian Group hosted an M&A-focused webinar that I moderated alongside Brian Love from Travillian with a distinguished panel that included three prominent investment bankers: Kade Machen from Stephens Inc.; Chris Murray from Piper Sandler; and Dan Bass from Performance Trust. The consensus view was that M&A activity is likely to pick-up meaningfully in 2021, and there seemed to be broad agreement as to how it is all likely to play out.

While noting that clarity is still needed with respect to asset quality, government policies, the vaccine roll-out, and the economy, Piper Sandler’s Murray indicated that discussions are taking place, and we’ll see announcements as soon as 1Q, with “volume picking up as we move through the year”. Kade Machen agreed with the assessment that deal activity will be “back-end loaded” towards the second half of 2021, noting that the flurry of announcements we’ve seen at the tail end of this year reflect agreements that were largely already in place earlier this year and were temporarily shelved with the onset of the pandemic. Machen specifically cited a transaction his firm had announced the week prior – BXS’ acquisition of Texas-based National United Bancshares, Inc. – noting that it was a “pre-COVID discussion that took a timeout” to re-assess credit and allow valuations to recover, while also further noting that we’ll see additional announcements “where the partners are already picked”.

Catalysts for new discussions that are taking place, per Dan Bass from Performance Trust, include recognition at the Board level by some smaller banks that COVID has effected a change in customer behavior and the need for technological innovation and the banks “just don’t have the budget to commit to the necessary investments”. This sparks the question of whether it is time “to look for a partner”. Murray agreed, noting that the pandemic has “accelerated the impact that technology is having across all industries”, while also citing the formidable spending power of the largest banks (top 20 banks spent $60 billion on technology last year), creating a “big barrier” for smaller institutions that will now need to attain greater scale.

All that said, the panelists were also in agreement that there are still some impediments that will likely forestall a tidal wave of M&A in the very near-term, leading all to agree that announcements in 2021 will be “back-end loaded”. Machen suggested that valuations remain a challenge, with many bank stocks having only regained half of the value lost in the early stages of the pandemic. Bass and Murray agreed, while Bass also noted that he is advising some buyside clients to wait for the potential target’s next regulatory exam, so that the “regulators can be the bad guy rather than the acquirer”.

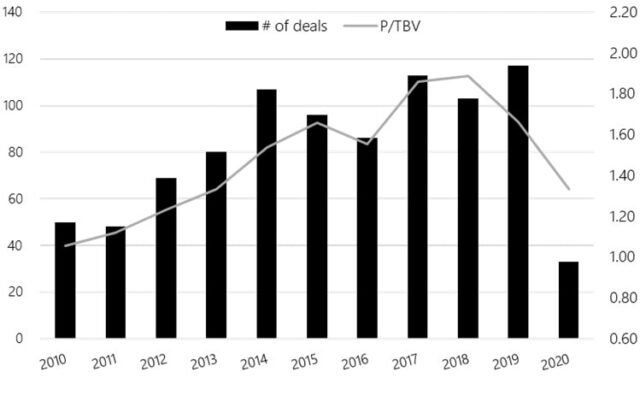

Source: S&P Global; Data as of 12/12/20

A pick-up in M&A should be good news for investors, with multiple ways to play it.

Historically, the correlation between improved bank stock valuations and a surge in M&A (or even just a gradual pick-up over time) is rather strong. In my experience, M&A can help to re-establish franchise value for all players in a given market, particularly coming off a downturn, while at the same time, human nature is such that deals have been more likely to occur in periods of rising, rather than falling, stock prices. Especially early in an M&A cycle, such as the one I think we’re likely to embark on shortly. There also tends to be considerable optionality in terms of how to play it from the investor perspective. For instance, one can own select M&A targets. While deal multiples will be lower at first, most sellers are nevertheless likely to command a market premium. Investors can also own the best-positioned acquirers, as the “deal math” tends to work well early in an M&A cycle, given the disparity in bank stock valuations (“strong” acquirers trading at a premium, acquiring weaker sellers trading at a discount”). Finally, investors can own what I’ll call the likely “combiners” – those banks merging with like-sized competitors in a “merger of equals” transaction at a low premium, a deal structure that should continue to be well-received by investors. Investor optionality tends to recede later in the cycle, when valuations tend to move toward parity and as a result, the deal math becomes more difficult, but that’s a question for another day!

The Travillian Group’s Banks and Credit Unions practice provides Search and Talent Advisory (TTG|Align) services to depository institutions across the country. Established in 1998, the firm has built a unique platform that touches every corner of the industry.

Our search and advisory professionals focus on building long-term, trust-based relationships with Boards, Executives and HR professionals. They assist our clients in the hiring of high quality, hard to find talent and provide full-life cycle consulting in such areas as succession management, leadership development, employee engagement, recruitment strategies and compensation.