Trends in tangible book value growth over time are a staple of bank stock valuation analysis

“…we believe tangible book value per share is a good measure of the value we have created for our shareholders.” – Jamie Dimon, Chairman and CEO, JPMorgan Chase

We wholeheartedly agree with Mr. Dimon. Throughout my career analyzing bank stocks, whenever I come across a new bank that I’d like to learn more about, one of the first metrics I would look to is the trend in tangible book value growth over time. In theory, assuming assets and liabilities are valued appropriately, tangible book value per share is the dollar amount that an investor would receive for each share in a liquidation scenario. So essentially, it’s the net worth of the company, a metric that any investor would like to see increasing over time.

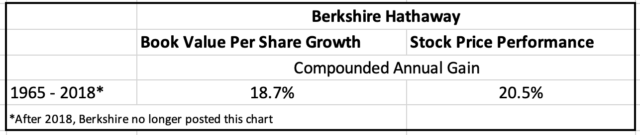

Assuming the company delivers returns over time that exceed its cost of capital, one can reasonably expect the stock to trade at some degree of premium to its tangible book value per share. For many years (but no longer), on the first page of the Berkshire Hathaway annual report, Warren Buffett had a chart comparing the trend in book value per share to the company’s share price performance – over long periods of time, these metrics were very highly correlated, which makes sense to us – growth in net worth should roughly correspond to long-term share price performance. We’ve found the same is true for banks, and there is plenty of evidence to support this anecdotal observation. Those banks that deliver tangible book value growth at a level exceeding peers over a long period of time tend to trade at relatively higher valuations and exhibit superior share price performance, while the opposite is true for banks that report stagnant growth or abrupt declines in tangible book value per share (commonly reflecting some combination of sub-optimal fundamental performance, capital or credit challenges, or value-destroying acquisitions).

The first half of the year will evidence nearly unprecedented declines in tangible book value per share

While it’s certainly been discussed, recent trends in tangible book value growth and the resultant negative implications for bank stocks have been vastly underappreciated, in our opinion. We’ve read some accounts noting that this has been the worst first half of the year for fixed income in the history of the bond market. While we can’t affirm that statement, safe to say it’s been a very tough environment for fixed income. Without getting too deep into the weeds on the accounting, we mention this because most banks classify a substantial majority of their fixed income investments as “available for sale”, and as such, this portion of the investment portfolio is marked-to-market at qtr-end.

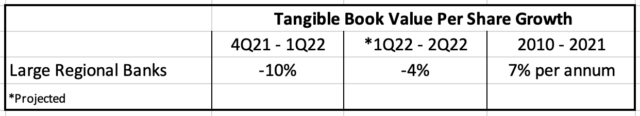

Longer-term market interest rates rose rapidly in the first quarter of this year, and advanced further during the second quarter, hurting the value of these fixed income investments. These marks run through accumulated other comprehensive income (AOCI), reported in the equity section of bank balance sheets. For the largest regional banks, tangible book value per share declined, on average, by 10% (and 40% annualized) during the first quarter of 2022, as compared to the most recent prior quarter, and we estimate will decline further in the second quarter, to the tune of roughly 3%-5%, on average, for the largest regional banks. A couple of these banks reported linked quarter declines in tangible book value of upwards of 20% for the first quarter. For perspective, since 2010, tangible book value per share for the average large regional bank grew about 7% per year.

There were several significant negative implications, which we still don’t think have been fully appreciated…

- First, the sharp linked quarter declines in TBV seemed to obliterate the rationale for stepping in to “buy the dip” in the stocks. It sort of felt like running in place from a valuation standpoint – the stock in question would be down 15%, but the corresponding decline of the same magnitude in tangible book value left the investor contemplating an investment decision at roughly the same TBV valuation. Moreover, at the time that banks were reporting these results in late April, market interest rates had risen further, and there were projections for more of the same for the foreseeable future. As a result, investors knew that further hits to TBV were likely in the periods ahead. And given the lack of transparency into banks’ investment portfolios, which remained dynamic as market conditions further evolved, precise forecasts were virtually impossible, and thus, analyst models seemed to just ignore the issue entirely.

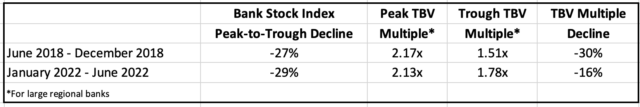

To illustrate the valuation conundrum facing investors, we looked back to the last major extended sell-off in bank stocks (ex-COVID) in late 2018, and found that the stocks on a peak-to-trough basis were down about 27%, while tangible book value multiples for the largest regional banks declined by 30%, from 2.17x in mid-June 2018 to 1.51x in late December 2018. This year, however, while stocks declined by even more on a peak-to-trough basis, by 29%, tangible book value multiples only fell by 16%, from 2.13x to 1.78x, making it harder to justify stepping in at valuation levels that didn’t seem all that attractive on the surface, given the magnitude of the macro challenges we seem to be facing. While it’s true that P/E multiples were indeed compelling on paper, these were heavily discounted for the increasing risk of recession, and many investors simply turn to tangible book value as the valuation measure of choice during periods of crisis because – again, in the words of Mr. Dimon – “…tangible book value “anchors” the stock price.” Bottom line, setting aside all other factors, the magnitude of these declines in tangible book value, in our opinion, in and of itself, served as an almost insurmountable headwind to a sustained recovery in bank share prices in the near-term.

- Second, the “TBV issue” as we’ll refer to it, is one of the main reasons, in our opinion, for the recent “chill” in bank M&A. While economic uncertainty and lower bank stock prices undoubtedly have also played a role, the risk of explosive inflation and the associated implications for sharply higher interest rates, meaningfully raises the bar for acquirers considering an acquisition. Consider that from deal announcement in September 2021 to deal close in April 2022, the acquisition of Happy Bancshares, Inc. flipped from impressively accretive to modestly dilutive to Home Bancshares, Inc. tangible book value per share, for the simple reason of the negative mark-to-market adjustment on Happy’s investment portfolio. As another example, in April 2022, it was reported that Seacoast Banking Corp. of Florida elected to revisit the transaction price it had offered to an acquisition candidate – lowering it by nearly 11% — to account for the rising rate environment. And in both cases – Home and Seacoast – these were very well-respected, experienced acquirers trading at premium stock currencies – in other words, they could afford to make and absorb these adjustments, but this option simply isn’t available to acquirers trading with a weaker stock currency and contemplating marginal transactions (which in our experience tends to be the vast majority).

- Third, while not accounted for in calculations of regulatory capital, AOCI marks hit tangible common equity – what Home Bancshares Chairman Johnny Allison famously referred to in the aftermath of The Great Recession as “train ridin’ money”. Regardless of how “temporary” or “transitory” higher interest rates prove to be, we would venture to guess that no investor will be comfortable seeing banks sporting sub-5% TCE ratios, particularly with no transparency into how it will all ultimately play out and the possibility that ratios can decline further still. We can still recall the pleas from bank management teams during The Great Recession and its aftermath, to focus on their company’s “well-capitalized” status, per the regulatory definition, as the market seemingly looked past the regulatory standard to tangible equity and an assessment of whether it was sufficient to withstand a “burn down” analysis after factoring in projected credit losses that had yet to be realized. We don’t recall how many banks remained “well-capitalized” when they were ultimately seized by regulators, but it wasn’t a small number. That’s not to suggest the sector is facing a similar situation and outcome today (we don’t think it is), but that experience is instructive in the sense that investors aren’t likely to look past continued degradation of tangible capital ratios, no matter how “transitory” market prognosticators deem it to be, or how healthy measures of regulatory capital appear to be.

and the counter-arguments, to be frank, either don’t seem to make much sense of are philosophically inconsistent

Of course, there is no shortage of rebuttals to the view that tangible book value impairments are more consequential than the consensus seems to appreciate. One that stands out is the notion that AOCI marks would simply be “earned back” over time, which strikes us as similar to the positive “spin” many look to assign to marginal, value-destroying M&A deals. We would ask a simple question in reply: How would the market react to a bank announcing an M&A deal that on Day 1 was 15% dilutive to TBV? After all, TBV dilution from M&A is “earned back” over time as well.

Other rationale we’ve heard is that it’s inappropriate to consider mark-to-market adjustments on just one segment of the balance sheet, especially since core deposit funding is more valuable in a rising rate environment. While we agree with the statement in principle, one must be intellectually honest in how it’s applied. For example, as interest rates were falling to historically low levels in the decade aftermath of The Great Recession, we don’t remember hearing calls from the Street to exclude the tailwind to tangible book value growth resulting from declining interest rates. Also, what about mark-to-market adjustments acknowledging that low-cost deposit funding was worth less during that period of historically low rates? In other words, you can’t have it both ways: if you want to be a philosophical purist, we can accept the premise that selective mark-to-market adjustments can be problematic and don’t really reflect economic reality, just make sure though that you also call it out when it works in the sector’s favor when the tide turns. Taking that analysis one step further, it’s fair then to ask how much of the sector’s 7% annual growth in TBV per share during the past decade was the result of the tailwind brought about by declining interest rates?

All in all, our conclusion to this point has been that a tradeable and sustainable rally in bank stocks is unlikely during a period when tangible net worth has been so meaningfully destroyed.

That said, are we approaching an inflection point?

There is a case to be made that even if not now, we may be approaching the point where the tide will turn, which the market will likely anticipate before we see the concrete evidence that it has occurred. A peak in inflation, economic weakness that results in demand destruction (but that doesn’t send the economy into a punishing recession), a surprising positive development in the war overseas are among the multitude of factors that could help to turn the tide. Indeed, in just the last few weeks, the rise in interest rates seems to have leveled off a bit, and oil prices have declined, while the “early reporting” banks have evidenced an ability to better navigate (vis a vis Q1) what was a treacherous interest rate environment during Q2. Should longer-term interest rates even remain just level with 6/30, and with bank earnings profiles projected to remain healthy for the foreseeable future, banks could again look forward to tangible book value growth in future periods. While we’re not ready to make that call, we see it as a plausible scenario.

Should it become more apparent that this scenario is coming to fruition, the most notable implication in our view would be the clearer rationale for buying the stocks, given the rate-driven shift from valuation headwind to tailwind. With respect to the outlook for M&A, our thoughts are similar to how we felt coming off the pandemic, that being that there is likely now a substantial backlog of transactions stretching back nearly a year that, once unleashed, could lead to a torrent of M&A. Recall that there was a noticeable slowdown in bank M&A announcements back to the second half of last year, due to rumored infighting and jockeying for position within the regulatory agencies charged with approving bank M&A applications. The M&A “chill” was then extended this year by the added headwinds from the “TBV issue”. Bottom line, once acquirers are comfortable that the rate environment has at least stabilized, and given a likely recovery in bank stock prices, we suspect we could see a very robust bank M&A cycle. On all fronts, only time will tell.