Why are certain banks consistently valued highest by investors?

We recently presented to the Board of Directors of a community bank and in preparation for the discussion, we were asked by the management team to address the question of why certain banks seem to consistently trade with the highest valuation premium. I’ve been analyzing banks for over 20 years, and when asked this question in the past, my off-the-cuff response tended to hit on the usual platitudes – the company was well-managed, was more profitable than the average bank through the cycle, conservative in its underwriting standards, yada, yada, yada. In preparation for this presentation, however, I realized that I had never researched the question in any great depth, and that the standard answers would be insufficient to appropriately address the question.

Our research resulted in what we think are some very interesting conclusions… We went into this project with an open mind and with no preconceived notions of what we might find. We looked extensively at financial data and qualitative information in our attempt to identify commonalities amongst the group of publicly traded bank stocks that traded at the highest multiple of tangible book value as of the measurement date, which was mid-October.

The common attributes that we identified across the universe of companies is as follows:

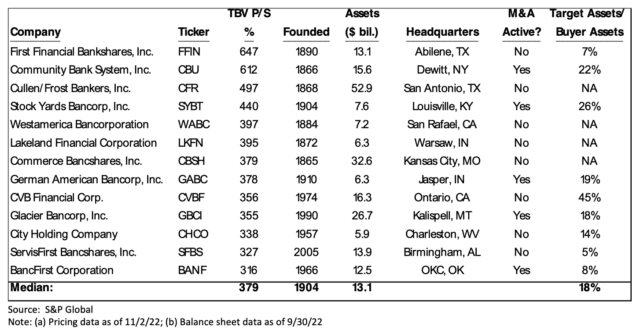

The typical company on the list (as measured by the median) was founded 118 years ago, in 1904. We stumbled upon this metric by happenstance, and we’re glad we did, because it’s something we had never considered as a common theme in thinking about this topic. Interestingly, only one company on the list, ServisFirst Bancshares, Inc. (SFBS) was founded during this century, in 2005, and the ‘next youngest’ company on the list, Glacier Bancorp, Inc., was founded in 1990, over 30 years ago. Perhaps it’s coincidence, perhaps not, but we also think it’s notable that the only company on the list considered to be more of a “growth stock” – ServisFirst – is also the company that was founded most recently. If we omit the two youngest companies from the calculation, the median founding year of the remaining 11 companies is 1890. Bottom line, it’s clear that a common theme amongst these companies is that they’ve been long-entrenched in their markets, which we think is significant when considered alongside other characteristics noted below.

Most of these companies operate outside of major metro areas and high growth markets. In perusing some of the most basic profile information on these companies, another tidbit that caught our attention was the fact that most companies on the list are based in markets that are hardly considered to be the most economically vibrant, densely populated, or fastest growing in the country. In fact, many of these markets would be characterized as just the opposite, located outside of the major metro areas and slower growing. Building on that last point, this list of the highest valued banks seems to be comprised primarily of companies that are well established in markets that grow at more of a “steady eddy” pace, tend not to exhibit boom/bust characteristics, and maintain dominant share of the deposit market. For instance, we note that First Financial Bankshares, Inc. (FFIN) has 54% deposit market share in its home market of Abilene, Texas, while Community Bank System, Inc. (CBU) ranks either first or second in deposit market share in 75% of the towns in which they do business.

The majority of companies are not highly acquisitive. We would consider only 5 of the 13 companies on the list to be “highly acquisitive”, and there are several that have been virtually inactive on the M&A front. Even more interesting from our perspective is the fact that the largest deal these companies have completed, on average, in terms of the target’s asset size relative to the buyer, is just 18%, and none have completed a deal larger than 45% of their asset size at the time of the acquisition (and the one at 45% is an extreme outlier). Rest assured, bank management teams are not likely to see this statistic cited by an investment banker anytime soon! But the evidence is clear – the highest valued banks tend not to be very acquisitive, and if they are, they favor smaller, bolt-on transactions rather than transformational deals.

Most companies are larger-sized community banks. A few years ago, there was quite a bit of evidence pointing to the fact that the highest valued stocks were companies with assets ranging from $5 bil. to around $9 bil. or so. This was considered the “sweet spot” for companies that were perceived to have the size and scale necessary to drive top tier fundamental performance, while avoiding the higher costs and greater regulatory scrutiny as companies surpassed the $10 bil. asset threshold. Clearly, this is no longer the case, as just 5 of the 13 companies on the list are within the $5 bil. to $9 bil. asset size range previously considered to be the “sweet spot”, while the average size of companies represented on the list is just over $13 bil., which ironically is right around the size range considered verboten several years ago for companies hoping to garner a premium valuation. The thinking there is that sitting just over $10 bil. was just about the worst place to be, as companies would incur all the additional costs and extra scrutiny without the size and scale necessary to absorb the added cost. How times have changed!

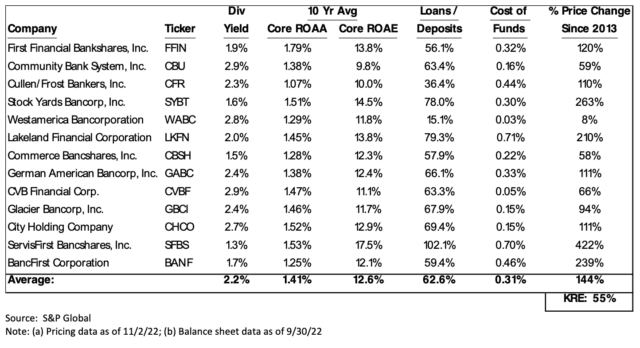

Solid profitability profiles no doubt, but not quite the highest in the land. Another interesting data point is that while each of these companies are consistent, high quality fundamental performers over long periods of time, they rarely tend to boast the very highest profitability profiles at any given point in time. In other words, there are always other companies that rank higher, yet those stocks are not as highly valued as this group.

The vast majority have a superior funding profile, a highly liquid balance sheet, a near-flawless long term credit track record, and pay a fairly modest cash dividend. Just about every company on the list is similarly situated in terms of balance sheet positioning and notable characteristics. For instance, virtually every company on the list has a superior funding profile, led primarily by a high-quality, low-cost core deposit base. For the most recent quarter ended 9/30/22, the average cost of funds for companies on the list was just 0.31%, with 5 companies reporting funding costs that were less than 0.16%. Moreover, virtually every bank, notably excepting the “growthiest” company on the list – ServisFirst Bancshares, Inc. – boasted an extraordinary balance sheet liquidity profile – the average on this metric was 63%, and excluding ServisFirst, it was 59%. From a capital management standpoint, we thought it was interesting to note that dividend yields for just about every company on the list was relatively modest – the average was 2.2%, with no stock yielding over 3%. Finally, and probably needless to say, the longer-term credit track record of virtually every company on the list is nearly flawless – one company did stumble materially during The Great Recession, but all others boast multi-decade track records of superior performance with respect to asset quality.

Loyal, long-term oriented shareholder base. Another characteristic we noticed was that the same institutional investment firms tended to pop up as top shareholders of many of these companies, along with a fair number of very large passive investment entities (and are thus unlikely to be sold, so long as the stocks remain in the requisite benchmark indices and meet governance requirements). For the active managers, from my two decades as a sell-side research analyst, I know that many of these investment firms (and the individuals responsible for picking the stocks) have been long-time shareholders of the companies on this list. This results in lesser “churn” in the shareholder base, creating an environment of relative stability so long as the company doesn’t stumble materially (which these companies rarely do, if ever). These investors don’t tend to trade out of these stocks when they appear “expensive” on paper, because the fact of the matter is these stocks always look expensive on traditional valuation metrics, and in most cases were trading at similar valuation premiums when the investors initially bought into the stock. And at the end of the day, they’ve been correct in their assessment, as the stocks on this list have vastly outperformed the benchmark, by almost three-fold since 2013 (share price for companies on this list up by 144% versus 55% for the KRE, not including dividends)!

Unveiling the “secret sauce”. Combining the qualitative and quantitative metrics together, the picture starts to come into clearer focus. These banks that are long entrenched in their markets start with an obvious relative advantage, given the dominant market share position they enjoy. This low-cost, extremely sticky funding profile forms the basis for a healthy margin, which in turn, and coupled with the likely deep customer relationships and institutional knowledge of its customer base, allows the bank to pursue and cherry pick the very best, highest quality, and safest lending relationships. With the “head start” on NIM provided by the low-cost core funding base, the bank doesn’t have a need to be fully “loaned up”, leaving the balance sheet extraordinarily liquid. This combination of positive attributes drives reliable, consistent, and superior through-the-cycle profitability, while M&A, if attempted at all, can be additive with very little risk, given favorable “deal math” due to the premium stock currency, and little cultural and integration risk owing to the bolt-on nature of the acquisitions.

Join us for an upcoming webinar! We will be hosting a webinar with three of the CEO’s from banks on this list in December. Additional details to be released next week.

Joe Fenech is the Managing Principal of SMBT Consulting, LLC, which provides consulting services to banks. The article represents the views and beliefs of Mr. Fenech and does not purport to be complete. The information in this article is provided to you as of the dates indicated and the data and facts presented herein may change. You should not rely on this article as the basis upon which to make an investment decision; this article is not intended to provide, and should not be relied upon for, tax, legal, accounting or investment advice. Mr. Fenech is also the Chief Investment Officer and Managing Member of GenOpp Capital Management LLC, an investment adviser that maintains exempt reporting status in the State of Indiana. Affiliates of SMBT Consulting, LLC may recommend to such affiliates’ clients the purchase or sale of securities of companies discussed in articles published by SMBT Consulting, LLC.