The consensus view is that last year’s challenges will extend well into the new year

Coming on the heels of a very challenging year for markets and bank stocks in 2022, many believe there will be no respite in the new year ahead. Geopolitical tensions, inflation, recession, higher interest rates, and Quantitative Tightening (QT) – so the thinking goes – will translate to reserve build for credit losses; deposit outflows; higher funding costs, balance sheet liquidity concerns and squeezed margins; slowing loan growth; higher expenses; and depressed “market sensitive” and mortgage-related fee revenues at banks.

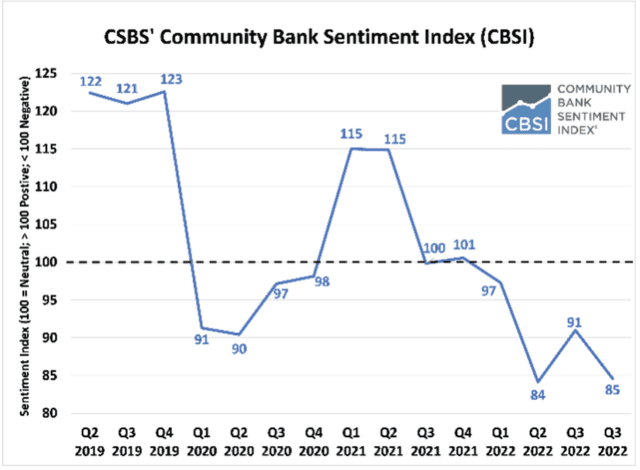

Against that perceived backdrop, it’s no wonder that Wall Street sentiment toward the bank sector is, to put it bluntly, pretty awful, with sell-side research analysts downgrading the sector in masse last month and so far early this year, and buy-side investor sentiment arguably even worse. And per the CSBS’ Community Bank Sentiment Index, community bankers have joined the negativity brigade as well (https://www.csbs.org/cbindex). Indeed, the most recent measurement suggests that community banker sentiment is lower than at any point in the last several years, including during the depths of the COVID pandemic! Specific drivers of bankers’ sour sentiment include inflation, government regulation, the cost and availability of labor, and cyberattacks (but interestingly, not asset quality – more on this below).

These considerations in the aggregate have driven bank stocks to just about the lowest absolute and relative P/E multiple in over two decades – yes, including during The Great Recession of 2008.

Exhibit I. Sentiment of Community Bankers Is At Lowest Level In Several Years

There are several legitimate counters to the bearish scenario, but they aren’t receiving much airtime or consideration

To be clear, we’re not minimizing the very real challenges noted above, nor are we suggesting that market volatility is likely to abate in the near-term – in fact, there’s a chance it could even intensify just ahead. The proverbial glass is filled halfway – of that there is no doubt. The question though is: is the glass half-empty, in the sense that we’re potentially on the precipice of another experience akin to 2008; or, is it half-full, suggesting that recent fears are overblown and better times may be just ahead?

We already laid out the bearish view, and the market to this point has made its ruling in favor of the bear camp, so let’s take a look at some of the counterarguments as we consider what might lie ahead.

“Peak NII” may indeed be upon us, but we must have missed the period when the market accorded the credit. Bank sector fundamentals have clearly improved over the course of the recent Fed rate hike cycle. As they typically tend to do in the early stages of a tightening cycle (but even more so this go-round because of the historic pace and magnitude of rate increases), increases in funding costs have lagged asset repricing, while at the same time, loan growth has been robust – all of which has translated to sharply higher net interest margins and overall net interest income.

That said, the concern now is that banks are likely to soon approach peak levels of net interest income – NII for short – as funding costs catch-up and asset repricing and loan growth likely slows. This is a key tenet of the bear case thesis. Is it likely to happen? Most likely, yes! But this pending development also obscures the lack of market recognition for the truly historic nature of what just occurred and perhaps over-dramatizes the danger of what may lie ahead.

Consider that in 2022, the bank sector (based on annualized Q322 year-over-year growth) grew net interest income (representing nearly 85% of total bank sector revenues) by 21%….21%! In my two+ decades following banks, that has happened exactly….never. To put a finer point on it, since The Great Recession in 2008, and setting aside 2022, the strongest years for NII growth were 2017 and 2018, at 11%, a little more than half the growth posted in 2022 and the median growth rate for that entire 14 year period was 6%. For the better part of 14+ years now, bank stock investors have bemoaned the tepid pace of revenue growth, and generalists have largely avoided the sector for that very reason. Bank of America did even better, growing NII by 24% from Q321 to Q322, and was rewarded with a stock price decline of nearly 26% for the year.

Now, if bank stocks had been credited last year with the historical P/E multiple of 14x the earnings produced by this record revenue growth, would we be more concerned about “peak NII” in ’23? Of course! But instead, as was the case with Bank of America, the bank stock index fell by 20% in 2022, indicating that banks were dinged for that record revenue growth, with calls for further price pressure ahead, because of “peak NII” that they never got credit for in the first place.

Provisions likely headed higher to boost reserve levels, but is this indicative of a larger problem, or potentially just an accounting entry? Alongside the “peak NII” argument, the foundation of the bear case seems to rest on the notion that with a recession potentially just ahead, banks will need to increase reserves to help absorb inevitably higher credit costs from soured loans. Admittedly, higher provisions are almost a guaranteed outcome, which will undoubtedly provide the bears with an “a-ha” moment. But this is due in part to relatively newer accounting standards – namely CECL – which, in very simple terms will reflexively require reserve build as macro forecasts change, regardless of whether banks are seeing material degradation within their loan portfolio (which as best we can tell, to this point, they are clearly not). Bottom line, with recession quickly becoming the consensus forecast, higher provisions in ’23 are inevitable, however, based on our conversations with numerous bankers, credit concerns haven’t emerged, so while higher provisions are almost guaranteed, it’s very possible that they won’t be accompanied by commensurate levels of loss (in which case they become dry powder for future earnings growth through reserve release).

Sentiment can be a contra-indicator of future performance…is it this time too?. We’ve been struck lately by the extreme negative sentiment that seems to have permeated the Street. Thinking back to the start of last year though, sentiment was broadly positive, coming on the heels of terrific market performance for bank stocks in ’21, and despite valuation levels that at the start of last year, in retrospect, seemed a bit stretched, at 14x forward earnings.

Now, we aren’t picking on our Wall Street brethren with that comment, because we were part of the group that leaned positive at the start of last year. But it is worth mentioning that sometimes human nature should be accounted for in this process as well, in the sense that after a year in which the entire bank stock index was up around 35%, and with seemingly no storm clouds on the immediate horizon, it was fair to assume at this point last year that the good times would continue to roll, despite elevated valuations. Could the same thing be happening in reverse this time around, following a year last year that was the worst for bank sector stock performance since 2008, despite valuation levels that are at least on paper, about five P/E multiple points cheaper than they were at this point last year when the Street consensus view was positive, and nearing two decade lows on both an absolute and relative basis?

Scars from The Great Recession still endure. When we started our investment fund a few years ago, one of the central tenets of our longer-term thesis was that bank sector valuations had been constrained for two reasons: (1) the lingering impairment of banks’ reputation for safety, soundness, and value that had been destroyed during The Great Recession; and (2) historically low interest rates which had eroded margins. However, over the past decade+, the bank sector had quietly healed itself through improved underwriting, the establishment of a more robust capital base, technology-driven enhancements, and the diversion of media focus to other pursuits (to “Big Tech”, etc), among other positive developments.

As a result, we anticipated a multi-year restorative path to improved through-the-cycle bank stock valuations, but that “show-me” story would likely necessitate the successful navigation of a true economic downturn, which we felt would help the sector to demonstrate conclusively that the 2008 experience was the exception rather than the rule. Until that happens, however, skepticism will continue to reign, particularly at what look to be major inflection points amidst periods of uncertainty, which is probably an apt characterization of the current situation. Ultimately, we think it portends opportunity, but not without twists and turns along the way.

QT is the wildcard in the equation

Quantitative Tightening – the process by which the Federal Reserve looks to shrink the size of its balance sheet – is in our view the wildcard in any prognostication – bullish or bearish – on markets and bank stock performance for this year. Without delving too deeply into the specifics, we’ll simply note that the Fed’s balance sheet grew approximately nine-fold – from around $1 trillion just prior to The Great Recession in 2008 to roughly $9 trillion in early 2022, at which point the Fed detailed a plan to gradually shrink the size of the balance sheet, a process which commenced in June 2022, and was accelerated in September.

From its peak, the size of the balance sheet is down about 5%, less than anticipated, but has been executed alongside the aggressive pace of Fed rate hikes, a combination of restrictive monetary policy actions that is without historical precedent. Unprecedented monetary policy actions can have unforeseen and unpredictable consequences, as liquidity is withdrawn from the system. For banks, which traffic primarily in financial assets and are subject to added balance sheet liquidity strain from the combination of higher interest rates and QT, the risks are particularly acute and frankly, just unknowable.

All things considered, look for opportunities to get more constructive

On the one hand, the risks and unprecedented nature of the current economic and market backdrop necessitate an elevated level of caution. One can’t credibly project with absolute certainty where things might be headed when the set of inputs in the decision tree are without historical precedent. Moreover, this cycle will undoubtedly unmask banks that were very poorly positioned, likely as soon as Q4 earnings season, and the market reaction we think will be swift and unforgiving.

That said, while the negative considerations have garnered the lion’s share of media and Street attention, there are notable positive developments that seem to be underappreciated, and should they play out, do not seem to be in any way contemplated in today’s historically low valuation levels. The bottom line: we’re looking for an opportunity to get much more constructive, rather than hunker down!

Joe Fenech is the Managing Principal of SMBT Consulting, LLC, which provides consulting services to banks. The article represents the views and beliefs of Mr. Fenech and does not purport to be complete. The information in this article is provided to you as of the dates indicated and the data and facts presented herein may change. You should not rely on this article as the basis upon which to make an investment decision; this article is not intended to provide, and should not be relied upon for, tax, legal, accounting or investment advice. Mr. Fenech is also the Chief Investment Officer and Managing Member of GenOpp Capital Management LLC, an investment adviser that maintains exempt reporting status in the State of Indiana. Affiliates of SMBT Consulting, LLC may recommend to such affiliates’ clients the purchase or sale of securities of companies discussed in articles published by SMBT Consulting, LLC.