What a difference a few months can make! In the weeks following April earnings conference calls, the banking industry shifted from a focus on tariff worries and market uncertainty to cautious optimism and improved borrower confidence. That tone was evident on July earnings calls and, as we enter September, we examine what the next few months can bring for banks (and bank stocks) based on recent market commentary.

1. Loan growth guidance was consistent, but funding it could push deposit costs higher.

Management teams’ improved tone was most on display in loan growth and pipeline commentary on July conference calls. Several banks noted that their clients’ optimism had improved (such as BOK Financial and Old National), which we expect to support borrowing activity in the second half of the year. Notably, growth trends sound especially constructive in the southeast, and we were encouraged to hear this sentiment from Ameris Bancorp and Renasant. Even so, many banks left their full-year loan growth guidance unchanged, perhaps a sign of caution for latent effects of tariffs and that the pace of paydowns remains a key variable that could weigh on net growth. Overall, a mid-single-digit growth rate was the most common guidance range in the conference calls we reviewed, and we expect few banks to exceed this pace. Doing so will raise questions regarding any loosening of underwriting criteria simply to grow. At a minimum, the investor conferences this month should provide timely updates to growth trends so far this quarter.

Importantly, the need to fund expected loan growth was a key theme on the 2Q earnings calls, with banks across the country discussing significant deposit competition (though, isn’t it always an intensely competitive environment?). Deposit growth was challenging last quarter, though this isn’t terribly surprising due to seasonal factors in commercial accounts and many banks should see balances rebound in 3Q.

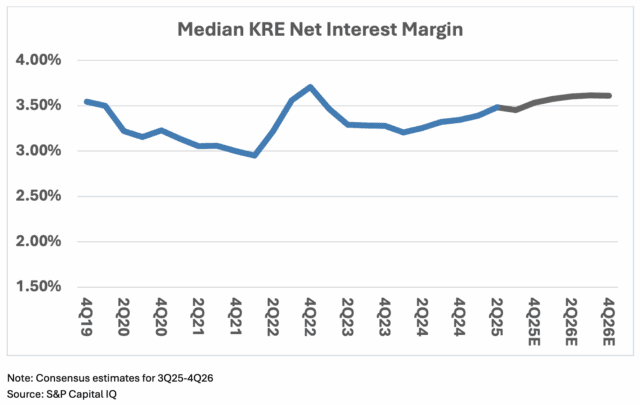

2. Earning asset repricing dynamics are still supporting margins, but other factors are at play too.

So, given these balance sheet dynamics, where does that leave the outlook for net interest margins? Well, there is still some room for earning asset repricing to support expansion, and many banks highlighted as such on their earnings calls, though this benefit is diminishing. Also, there should be opportunities for banks to improve funding costs on the wholesale side as brokered CDs mature but, similarly, this benefit has also waned from a few quarters ago. In addition, competition for core deposits could keep a lid on funding cost improvement, especially if loan demand accelerates.

Fed rate cuts would provide some benefit to deposits costs, however, many management teams have taken actions to make their balance sheets fairly neutral to moderate rate changes, so the net effect on margins is likely to be limited. Even so, liability-sensitive banks, such as First Foundation, QCR Holdings and USCB Financial, stand to benefit from rate cuts. Of note, most management teams incorporated two 25 basis point rate cuts in 2H in their guidance. Could these cuts result in a steepening of the yield curve? Time will tell. As the chart shows below, sell-side analysts expect the median net interest margin of the banks in the SPDR S&P Regional Banking ETF (KRE) to dip this quarter, but then slowly grind higher beyond that.

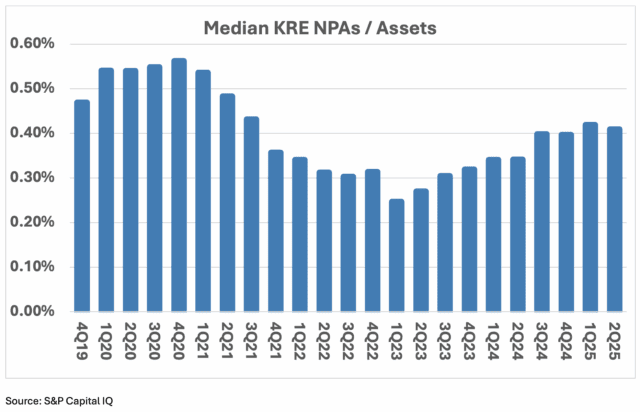

3. Where is the credit deterioration?

Credit quality was also a key theme on 2Q earnings calls, as bank stocks remain highly sensitive to deterioration. We have yet to see a big spike in problem loans to overly concerning levels (though NPLs have trended higher off the historical lows seen a couple years ago); however, a few banks experienced an increase in NPAs and/or classifieds in 2Q. Not surprisingly, the banks that posted notable negative credit migration last quarter (beyond modest fluctuations in problem loans) saw weakness in their stocks after the earnings release (Peoples Bancorp comes to mind). Beyond that, investors are mindful of potential weakness that may emerge as the full effect of tariffs take hold. They are also diligently watching credit trends in a few areas, including coastal CRE office (obviously), small ticket leasing and consumer. Notably, many banks with elevated CRE office books already trade at discounts to the rest of the group. Despite well-publicized problems in this category, significant industrywide charge-offs have yet to materialize, perhaps supported by cash infusions from private credit.

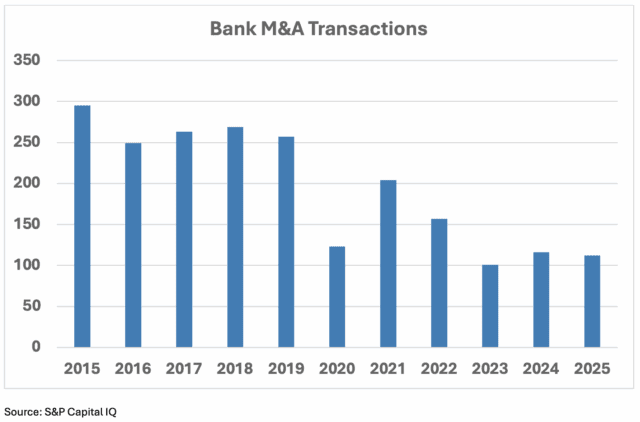

4. The catalysts are present for the imminent M&A wave to finally begin.

The last key theme prevalent on nearly all 2Q earnings calls was the outlook for M&A. With some clarity around tariffs, more comfort around interest rate marks and a more accommodative regulatory regime, the ingredients are set for the long-awaited M&A wave. There are green shoots in deal activity, as YTD M&A announcements (112 as of August 31) are close to exceeding deal activity for all of 2024 (116 deals) and have already surpassed 2023’s total (101), according to S&P Capital IQ.

The big deal announcement in July was the Pinnacle-Synovus tie-up and, clearly, this deal was not the M&A catalyst investors had been waiting for as the shares of both banks sold off sharply after the announcement. We believe investors are somewhat skeptical of large mergers due to the lengthy integrations that follow, which can result in a slower pace of recognizing the shareholder value large deals claim to create. Even so, community bankers should be looking at deals to solve for longer-term, industry-wide issues that are at play, such as succession planning gaps and the need to scale to support investments in technology. In our view, TowneBank’s recent acquisition announcement for Dogwood State Bank embodies good decision making from a target. Dogwood has certainly earned its independence as it boasts strong profitability (ROA of 1.36% and ROTCE of 14.2% this year), but the decision to partner with a larger institution ensures it will have the scale to continue to serve customers over the long term.

Importantly, we believe pricing expectations of buyers and sellers remain wide, which is keeping some deals from coming to fruition. Oftentimes, sellers care more about the price at deal announcement, rather than the initial stock reaction of the buyer or the long-term opportunities the merger provides for shareholders. Meanwhile, buyers are becoming more selective with their targets, placing a high value on retaining capacity to complete potential deals that move the needle the most.

5. Given this commentary, how are bank stocks performing?

The initial reaction during the latter days of 2Q earnings season was fairly negative for the KRE, with it selling off into August. Sell-side analyst estimates did not change much, with consensus numbers for the vast majority of banks we examined up slightly for 2026, suggesting the stocks’ initial negative performance was more related to broader market fluctuations and multiple compression rather than earnings concerns (though these concerns could manifest themselves in future earnings estimates revisions). However, bank stocks have rebounded over the last couple weeks, responding especially well to Chair Powell’s Jackson Hole comments, with the KRE rising 5% on August 22.

Looking ahead, management team commentary at bank conferences this month should shed some light on any effects of tariffs that may have emerged in August, which could throw cold water on some bank stocks. Alternatively, if the effect of tariffs is said to be rather modest, the recent rally in bank stocks could continue. Meanwhile, among the conference calls reviewed in July, we heard the most optimism out of the southeast region compared to other areas of the country. As mentioned, management teams there sounded a more positive tone for their economies, noting their clients’ confidence is trending the right direction. We are hopeful this tenor of commentary will continue. Plus, the median bank in the KRE is trading at 10.6x 2026 estimated consensus EPS, while the median bank in the southeast is at 10.9x, which is just modest premium for a more encouraging outlook. We think this premium is worth paying.

Andrew Liesch is the Head of Bank Strategy at Travillian. Email aliesch@travilliangroup.com for more information.