Ten years ago, it was hard to imagine a world where a customer would select a bank based on something other than geography, relationships, or rates.

The terms of competition were simple, and the products were comfortably commoditized. But that all changed with digital banking and the advent of consumer-facing fintech.

Fintechs took a different approach to financial services than their bank counterparts, betting on something more ephemeral than the strength of the balance sheet or the number of branches. Their measure of success was whether they created experiences that solved real customer problems better than anyone else. And that focus led them to build thoughtful products that divert market share from banks.

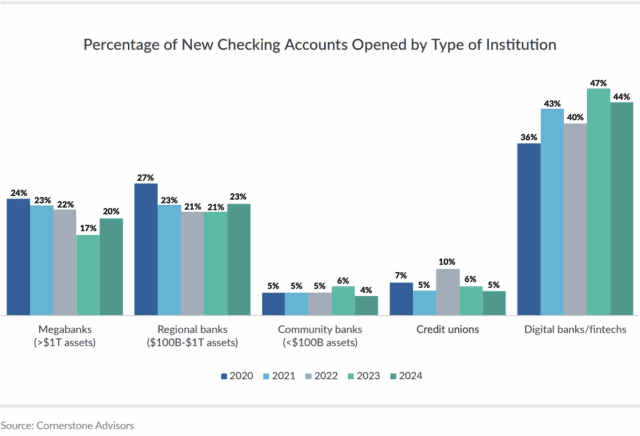

Under a headline intimating that deposit displacement is “killing” banks, new research from Cornerstone Advisors revealed late last month that “more than $2 trillion has moved out of traditional financial institutions and into fintech investment and high-yield savings accounts in the past few years.” The firm also found that the share of new checking account openings garnered by fintechs, neobanks, and digital banks grew to 44% in 2024, after peaking at 47% in 2023. Only 4% of new accounts were opened at community banks in 2024, according to the survey.

To reverse this trend, banks need to take a play from the fintech book and focus on product. Travillian recently spoke with three institutions that developed a competitive edge doing just that.

Building in the War Room: How Cross-Functional Teams Drive Payment Innovation

Building products people love isn’t something that’s new to banks. Laurel Road student loan refinancing was spun out of a bank; so was Zsuite Technologies for paying property managers. Trent Sorbe’s Central Payments followed in their footsteps after being founded within the payments division of the Central Bank of Kansas City in 2014.

Central Bank is a certified CDFI with a longstanding commitment to revitalizing underserved neighborhoods. The bank’s deep understanding of those communities contributed to its success with Central Payments. The bank’s CEO, Steve Giles, said in a press release at the time of the transition that the company grew from a desire to expand CBKC’s reach among low- and moderate-income consumers through products like payroll cards, prepaid cards, and remittances.

After the spin-out, Sorbe couldn’t stay away from building for long. In 2024, he joined $5.4 billion asset First International Bank & Trust as Chief Payments Officer. The bank had acquired and rebranded an ACH payment processing platform five years before Sorbe joined. It was a successful investment for the bank but operated in a fairly narrow vertical with a concentrated revenue stream. Sorbe was brought in to grow the business.

The bank’s ACH platform, Kotapay, processed $103 billion in originations last year almost exclusively in the payroll space. But Sorbe and his team are just getting started. “Kotapay is really the start of what we view as a very rail agnostic approach,” says Sorbe.

Earlier this summer, Sorbe and a cross-functional team were hunkered down for a “product war room,” working on an embedded banking feature for the firm’s key customer demographic: payroll platforms. In the six months prior, Sorbe and his counterpart Brooke Fitts, Head of Payments & Product Strategy, had developed over 100 pages of notes as they went back and forth on product ideas.

Sorbe showed me the thick, 3-ring binder on our call and laughed as he reassured me, “[d]on’t worry, we don’t just hand this to our Head of Compliance and say, ‘look what we want to do!’ This is really just throwing it all down. And then we’ll work from that to refine and lay out the objective of the product, the four or five KPIs that are the most indicative of success or failure, and the user experience we envision as it relates to those KPIs.”

Once the product objective is established, Sorbe uses the war room to hammer out customer journeys and data flows. The cross functional participants always include the head of development, head of risk, a senior marketing person, and a project manager. Other participants could vary based on the product, but the goal is that “they’re people who can come back to their teams and effectively communicate the vision to them,” according to Sorbe.

After the product war room has the flows about 80% down, the team takes a couple of weeks to refine their plan while compiling their business requirements into a document that will be handed off to developers to execute.

Look at a product and break it down to its most fundamental structure. Bust it down to its core and build back off of that.” – Trent Sorbe, Chief Payments Officer, First International Bank & Trust

Regardless of the process a bank uses, Sorbe suggests letting first principles guide their approach. “Look at a product and break it down to its most fundamental structure,” Sorbe advises. “Bust it down to its core and build back off of that.”

The Software Bank: Building Products from the Charter Up

The new product out of Austin Capital Bank is a great example of what it means to build from first principles. When the bank was developing its new Fort Knox High Security Savings Account, it stripped down the assumptions of what a savings account should look like.

“We’re a bit contrarian,” Erik Beguin says. “Most banks are trying to balance convenience and security. And you really can’t because the more convenient you make your account to move your money, the less secure it is. We really have just focused on security. And we have introduced intentional friction.”

In a poignant example of first principles product thinking, Beguin’s team of engineers decided one simple way to keep money from moving out of the account was to give it an identifier that could not be processed by payment systems. “We could write your Fort Knox account number on a piece of paper and hand it on the street, and nobody can defraud you using that account number.”

This way of conceptualizing new opportunities comes naturally for Beguin, who did tours in corporate venture and product management for Procter and Gamble and a payments fintech before founding the Austin Capital Bank. That background was particularly instructive as Beguin was planning the bank and its tech strategy. Instead of relying on third parties and fintech partners, Beguin wanted to build its own products under its own charter.

“We are essentially a BaaS bank for ourselves,” Beguin explains. “So when we design a product, we design it with compliance, operations, bank economics, everything already all built into it. We also don’t have to have two or three parties negotiating for how we’re going to split a pie.”

Not having to split the pie as often as other banks is working out well for Austin Capital. The bank’s NIM was an impressive 6.99% in 2024, and has been consistently strong the last five years — and throughout the tricky interest rate environment of 2022-2023. The bank’s assets grew from $291.8 million in 2020 to $459 million in 2024 with a 12.0% CAGR.

Over 70% of Austin Capital’s staff are technical employees and, in that way, Beguin says, “we’re really more like a software company with a banking charter. I don’t have a commercial lender here. We have one personal banker. We might have just two visitors to our lobby in a day but we will open between 700 and 900 accounts online every day.”

Austin Capital is bending toward nirvana with products like its CreditStrong offering. It looks and feels like a credit-building fintech but also gets to market the trust of a bank. The CreditStrong site boasts, “[a]s a bank, we work directly with all three major bureaus,” and “[w]e don’t have ‘Bank Level’ security. We have BANK security.”

“A traditional community bank might define community by geography. We define community by a set of consumers or businesses that have a common unmet need. And then we build a solution for that need.” – Erik Beguin, CEO, Austin Capital Bank

Whatever Beguin’s next product will be, it’s sure to be optimized with a specific customer journey in mind. “Rather than taking traditional banking products and trying to sell somebody seven of your accounts because that will be a lifetime relationship, we focus on niches. Unique needs,” Beguin says. “A traditional community bank might define community by geography. We define community by a set of consumers or businesses that have a common unmet need. And then we build a solution for that need.”

Innovation Without the Theater: FNBO’s Test-and-Learn Mindset

But banks don’t have to break the mold to benefit from product innovation, according to 23-year First National Bank of Omaha veteran, Marc Butterfield. As SVP, Head of Market Expansion & New Product Development, Butterfield oversees innovation in the bank’s partnerships division.

“With a lot of banks, they immediately feel like they need to compete with fintechs by disrupting an industry or coming up with a brand-new product. But I don’t think it needs to be that complicated. The biggest opportunity is just around building a test-and-learn muscle.” – Marc Butterfield, SVP, Head of Market Expansion & New Product Development, First National Bank of Omaha

“With a lot of banks, they immediately feel like they need to compete with fintechs by disrupting an industry or coming up with a brand-new product,” Butterfield says. “But I don’t think it needs to be that complicated. The biggest opportunity is just around building a test-and-learn muscle.” When it comes to product development, Butterfield encourages banks to ask themselves fundamental questions like, “How can we take an existing product we have and iterate on it? What capabilities do we have and can they serve markets that we haven’t thought about?”

Innovation is embedded throughout the $31 billion asset bank in Omaha. Teams focus on iterating with simple test-and-learn cycles. A small group under Enterprise Architecture keeps an eye on emerging technologies like stablecoin. And an Enterprise Innovation Council tracks all of the bank’s innovation efforts, categorizing projects as either long-horizon efforts or projects within 12 months of “production” (i.e. being used in the real world).

Whatever processes a bank chooses, Butterfield says there’s no need to take on wide-scale efforts like employee idea contests. He says banks should first be clear on their business purpose for an innovation effort, “then find people in the bank that already want to do it. There are hungry, curious people in the bank who are usually easy to find. Give them two hours a week to think about this stuff and see what they come up with.”

Outside of the organizational setup, the frameworks FNBO uses to accomplish product innovation are straightforward. Every potential project starts by defining a clear business outcome. Does it align with the bank’s strategy? Is there a path to creating value?

Only after those questions have been answered does a project move forward. From there, Butterfield explains, it’s really just a matter of conducting research with customers and leveraging some sort of testing environment to safely test drive a product with a small subset of users.

FNBO tracks several metrics to assess the efficacy of its innovation efforts, including how much of the bank’s revenue comes from products or business lines developed within the last five years. And while FNBO’s innovation efforts have led to impressive performance (at 11.90 the bank’s ROAE is above industry average), Butterfield cautions banks to go into innovation with a long-term mindset. “You have to have the stomach for it because it could be a five-to-10-year payback from a financial perspective, minimum. You have to be willing to make pivots.”

Getting Started

The framework these successful banks follow is predictable: Start with customer problems, not bank products. Build cross-functional teams that include compliance, operations, and customer-facing staff. Embrace iterative development. Be patient when it comes to payback.

You don’t have to redesign your entire organization at once to embrace the major principles of product development. Here are a few ideas your bank can implement in the near term to bring more product focus into to your work:

- Expose your team to product development practices like customer interviews, journey mapping, ideation sessions, and prototyping.

- Be intentional about foregrounding what the bank does best, and which customers are or could be benefiting from that strength most.

- Start small but meaningful: a revised onboarding flow, a small‑business tool, or a lending enhancement. Form a cross‑functional squad to tackle a small change. Empower it with clear metrics and authority.

- Begin leveraging user surveys, analytics, and qualitative interviews to iterate.

- Share learnings, celebrate wins, and work to institutionalize customer‑centric frameworks.

Amber Buker is the Chief Research Officer at Travillian.

Want to learn how product discipline can help your bank compete? Engage Travillian’s Propel Bank Strategy Lab to help your team identify ideal customers, design products people love, and execute go-to-market strategies that drive growth. Email abuker@travilliangroup.com for more information.