Bank M&A Activity Is Increasing as Regulatory and Economic Frictions Ease

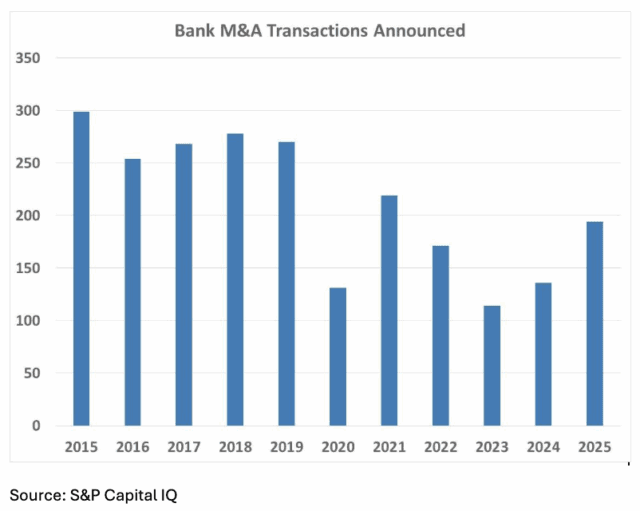

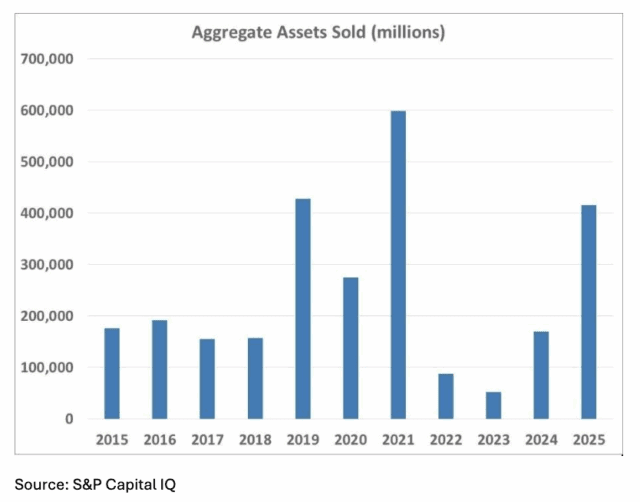

The bank M&A environment is on fire! In 4Q25 alone, there were 50 bank acquisitions announced, and although this was down from 57 in 3Q25, activity easily surpassed the 34 announced in 4Q24 (data sourced from S&P Capital IQ). Stepping out further, 2025’s 194 deals were the most since 2021’s 209 transactions. At the NEXT Forum in early October and in seemingly every industry discussion since then, a recurring theme was M&A. This shouldn’t be terribly surprising, as many banks are looking for an exit, while others look to add scale to cover operating cost pressures across several areas of their franchises. In addition, a softer regulatory regime in Washington is contributing to increased optimism for acquisitions, with the Trump administration approving deals at a much faster clip than under Biden (median days from announcement to completion was 119 in 2025 versus 176 in 2024; almost two months faster!) The new administration is also allowing banks to have multiple pending deals concurrently and is effectively giving a stamp of approval for large bank acquisitions.

Takeaway 1: Stocks Lag After Deal Announcements, but There are a Few Winners

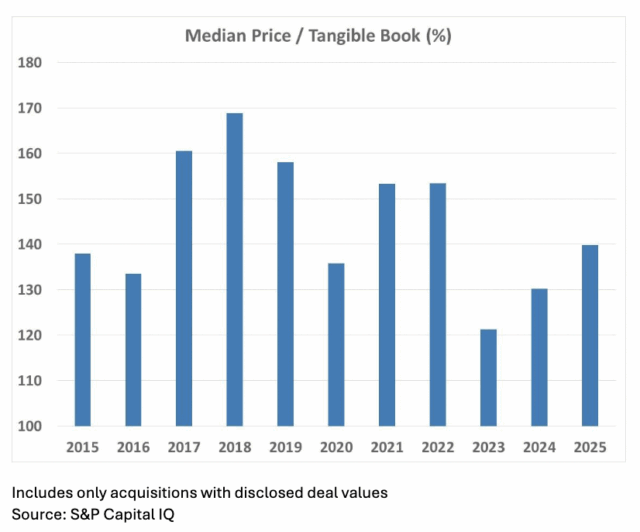

After a lull of deal announcements in 2023 and 2024, the rebound in activity is a welcome sight for many in the industry, including both prospective buyers looking to expand their franchises and sellers seeking an exit. Transaction values are also trending higher, which is a positive development and could beget more deals if the bid-ask spread between buyers and sellers narrows.

While the rebound in deal activity and valuations benefit many in the industry, it’s important to understand how the actual owners of these banks view the deals. Unfortunately, the reaction from bank investors is not exactly inspiring after the announcements. Of the 40 deals with a publicly traded buyer announced since July 1 (on a major exchange), the median return in the buyer’s stock price on the first trading day was -1.4%, compared to a median 0.1% increase in the SPDR S&P Regional Banking ETF (KRE). And for the most part, the stocks have continued to underperform the KRE, with the median return since each announcement of 0.5%, falling short of the median 5.6% increase in the KRE (through January 5). Moreover, just 9 acquirors have outperformed the KRE since they announced their respective deals.

Investors are making it quite clear that they are not keen on owning banks that are growing through acquisition. The underperformance in the stocks could stem from disbelief that the cultures of the two banks are complementary, or perhaps they are shying away from tangible book value dilution. Also, the deal announcements could reveal an unexpected shift in strategy, especially if the acquiror’s growth did not include M&A historically. Importantly, there have been a few outperformers, such as Equity Bancshares (EQBK), First Community Corporation (FCCO) and Investar Holding Corporation (ISTR), whose stocks’ returns exceed two standard deviations over the mean since announcement. The bank M&A stock performance table here contains stock return details on acquisitions by a publicly traded bank buyer since July 1, 2025.

Takeaway 2: It’s All About Deposits, Deposits, Deposits

All that said, the weak performance of the acquirors’ stocks could be simply near-term stock reactions as we have not had enough time for the deals to be fully integrated. As Head of Bank Strategy at Travillian, I advise bank management teams to take a longer-term approach. If a buyer is acquiring a fantastic institution with scarcity value that is not easily replicated (think: a strong core deposit base) and if the deal is priced appropriately, the rationale for doing it is likely on solid ground for the long-term. In my work, I also help banks in their investor relations efforts, where maintaining consistent, clear contact with shareholders and potential investors is crucial as deals are pending and being integrated.

Acquiring strong core deposit bases can be a huge driver of long-term shareholder value, especially if a target brings both a low loan-to-deposit ratio and cost of deposits. As Jonah Marcus, Partner and Portfolio Manager at Endeavour Capital Advisors, stated onstage at the NEXT Forum this past October, “it always starts with deposits for us. It’s what differentiates banking companies from lending companies. It is ultimately the intrinsic value of these institutions.” He continued, “the market actually has been fairly clear that if your bank has gotten better on those metrics [loan-to-deposit ratio and cost of deposits], you’re a relative outperformer in a world where there’s been relative underperformance.” Marcus’ quotes underscore investors’ views that, if a bank is acquiring a great deposit franchise and liquidity that can be deployed into loans, the buyer’s stock is positioned to outperform.

Takeaway 3: There Are Opportunities Out There; Nicolet Puts its Currency to Work in MidWestOne Deal

Even though the initial stock reaction of recent bank deals does not exactly rouse excitement, I believe there are still opportunities for long-term investors to capitalize on bank M&A. Nicolet’s (NIC) deal to acquire MidWestOne (MOFG) is one such transaction. Since the deal was announced, NIC has underperformed the group, declining 1.6%, while the KRE has increased 10.6%, despite continued strong execution on a standalone basis. Of course, there is integration risk in deals of this size (MidWestOne is 41% of Nicolet’s current $9.0 billion asset base), but I am buying into CEO Mike Daniels’s comment that he looks at the acquisition “from the lens of the shareholder,” and that he expects to “deliver top quartile, if not decile, results.”

As Scott Studwell, Head of U.S. Depositories and Co-Head of Equity Capital Markets at investment banking firm Stephens also stated from the stage at the NEXT Forum, “potential buyers that have earned a currency are very reluctant to use that multiple on somebody else, meaning they’ve worked hard to build that multiple themselves.” This sentiment perfectly describes Nicolet. Its focus on shareholder value has ultimately led to a well-deserved, premium valuation, as NIC shares are currently training near 220% of TBV. With the MidWestOne deal, the company is taking advantage of the market — anointing it with a strong valuation, and deploying it in a deal that it believes improves its franchise, signaling that it has overcome any reluctance to use its stock on another bank.

From a fundamental perspective, MidWestOne brings a lower loan-to-deposit ratio (81% vs 90%) and a slightly lower cost of deposits (1.93% vs. 2.07% in 3Q25), which provides opportunities for balance sheet improvement. Its core ROA falls short of Nicolet’s (TTM of 1.01% vs. 1.69%), though after the integration and incorporating fully phased-in cost saves, management expects the ROA of the combined organization to push toward 1.80%, easily exceeding the peer median of 1.12%.

What Does 2026 Have in Store?

In a few words: the pace of deal activity will continue to accelerate. Momentum carried straight through year-end, underscored by OceanFirst (OCFC) announcing its acquisition of Flushing Financial (FFIC) on December 29th. Combined with the rebound in deal activity during 2H25, this reflects an increasingly active market and sets the stage for further acceleration in 2026. Softer regulation is clearly playing a role, as deals are approved at a much faster clip than in 2024. “From a regulatory standpoint, the handcuffs are off” said Studwell. He continued, “you’re seeing multiple applications pending for certain acquirors, which is meaningfully different than where we were 18 months ago.” Historically, an average of 3-4% of FDIC insured banks are sold every year and 2025 was on par with this. But with the environment more conducive to M&A than in recent years, exceeding that range seems likely.

There is the old adage that banks are sold, not bought, and the reasons why a bank chooses to sell have changed little over the past several years: Age of management and the board, succession planning, and the need for liquidity. These themes have been driving small banks into the arms of credit union buyers, who pay all cash and can solve many of the aforementioned problems. Credit unions acquired 16 banks last year and, although this is down from 19 in 2024, these non-traditional buyers will continue to pose an attractive alternative, especially for banks sub-$500 million in assets.

What Gets Bank Stocks to Improve?

With the median KRE bank trading at ~150% of TBV and 10.3x 2026E consensus EPS, bank stocks continue to present a good value play for investors, but I continue to look for catalysts. Sticking with the M&A theme, seeing an acquiror’s stock react well in a larger deal or two could garner attention from generalist investors. However, generalists also remain cautious on credit quality — Jamie Dimon’s quote about cockroaches in October didn’t help, especially with a few blowups at private credit funds and concerns over CRE office space in coastal markets.

Even so, while the group may not attract a ton of attention, I think the deal list above presents a few attractive opportunities for investors to sharpen their pencils on and dig into a bit further. Beyond Nicolet, these include Mid Penn Bancorp (MPB), South Plains Financial (SPFI), and First Mid Bancshares (FMBH). While there will be some investors that put these stocks in the penalty box because they are in the process of doing and integrating a deal and taking on some tangible book value dilution, the playbook to get the stock up is right in front of everyone: execute on the deal and demonstrate how the acquisition improved your franchise.

Every acquisition is a pivotal part of any bank’s story so the need for strong communication with investors (and potential investors!) is crucial. At Travillian, we work with banks to ensure their story is communicated clearly in pivotal moments. If you’re a bank executive thinking about how to sharpen your investor messaging, reach out to Andrew Liesch, Head of Bank Strategy, at aliesch@travilliangroup.com.