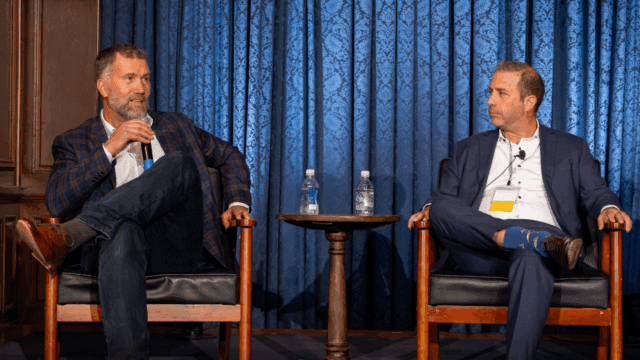

This episode brings together host Andrew Liesch, Head of Bank Strategy at Travillian, and Stephen Scouten, Managing Director and Senior Equity Research Analyst at Piper Sandler, for one of the most grounded conversations you’ll hear on bank performance heading into 2026. Scouten lays out why management teams feel more optimistic than they have in years, why valuations remain stubbornly low, and what rate cuts, deposit costs, CRE fears, and a wide-open M&A window mean for the industry.

LISTEN HERE: SPOTIFY | APPLE PODCASTS

Key Drivers Shaping Bank Performance, Valuations, and M&A

00:00 – 01:11 | Setting the Stage

Andrew introduces Stephen Scouten, who covers banks across the Southeast for Piper Sandler. Scouten outlines his background and the markets he knows best, from Florida to Virginia.

01:11 – 02:59 | The Mood: Surprisingly Positive

Fresh off Piper’s East Coast bank conference, Scouten says management teams are the most upbeat he’s heard in over a decade. Regulatory relief, stable-to-improving margins, and a healthier M&A environment are driving confidence.

02:59 – 04:57 | Why Generalist Investors Still Aren’t Back

Valuations look appealing to bank specialists, but generalists still haven’t returned after the SVB collapse. Scouten explains the psychology: they’d rather own JPM than risk a mid-cap.

04:57 – 07:24 | Rate Cuts and Deposit Costs

Banks have been able to push deposit costs lower far more than expected. Stable and even expanding NIMs remain on the table, even for asset-sensitive banks.

07:24 – 08:42 | Loan Growth Reality Check

The Southeast continues to outperform. C&I and HELOCs are bright spots, but CRE, historically the engine, still isn’t firing. Rate cuts could help, but repayments will rise too.

08:42 – 10:08 | CRE: Still More Fear Than Facts

Loss content remains minimal. Scouten argues the “CRE crisis” narrative is media-driven more than data-driven. Even banks with high CRE concentrations aren’t showing distress.

10:08 – 12:43 | AI, Tech Spend, and Stablecoins

AI is still mostly buzz, with real savings coming only at the margins. Stablecoins dominate investor conversations, but Scouten sees tokenized deposits as banks’ real path forward.

12:43 – 16:11 | The M&A Window Opens

More rate cuts + improved regulatory timelines = more deals. But sellers’ expectations and valuation gaps are still the biggest roadblocks. Many banks don’t want to appear like acquirers because the market punishes them for it.

16:11 – 18:47 | Activist Pressure & Why Boards Might Be Forced to Move

Activists are heating up again, pushing under-earning banks toward strategic alternatives. The regulatory climate makes it easier to strike deals.

18:47 – 21:35 | Stock Ideas: SouthState & Atlantic Union

Scouten pitches two names: SouthState (too cheap for its performance) and Atlantic Union (a “show me” story with strong potential). Both simply need to execute.

21:35 – 23:24 | Buybacks and Balance Sheet Moves

Large banks are aggressively repurchasing shares thanks to strong capital generation. Sub-debt repayment has been common, while restructurings have mostly been completed.

23:24 – End | Closing Thoughts

Andrew and Stephen wrap up with a look toward 2026 and how the next rate cycle could shape the entire sector.

Disclosures for universe of: Stephen Scouten

1. I or a household member has a financial interest in the securities of the following companies: none

2. I or a household member is an officer, director, or advisory board member of the following companies: none

3. I have received compensation within the past 12 months from the following companies: none

4. Piper Sandler beneficially owns 1% or more of a class of the following companies: none

5. Piper Sandler has had a client relationship or has received compensation for investment banking services from the following companies within the past 12 months: AMTB, AUB, COSO, FCNCA, PNFP, RNST, SBCF, SFNC, SNV, SSB, UBSI, USCB

6. Piper Sandler expects to receive or intends to seek compensation for investment banking services from the following companies in the next 3 months: FCNCA, PNFP, SBCF, SFNC, SNV, USCB

7. Piper Sandler was a managing underwriter of a public offering of, or a dealer manager of a tender offer for, the securities of the following companies within the past 12 months: COSO, FCNCA, SFNC, SSB, USCB

8. Piper Sandler has had a client relationship and has received compensation for non-investment banking securities related products or services in the past 12 months for the following companies: ABCB, AMTB, AUB, BKU, CADE, FBNC, FCNCA, HBCP, HOMB, HWC, ISTR, OBK, OZK, PB, SBCF, SFBS, SNV, SSB, STEL, TRMK, UBSI, UCB

9. Piper Sandler has had a client relationship and has received compensation for non-securities services in the past 12 months for the following companies: none

10. Piper Sandler is a registered market maker for the following companies: ABCB, AMTB, AUB, BKU, CADE, COSO, FBNC, FCNCA, HBCP, HOMB, HWC, ISTR, OBK, OZK, PB, PNFP, RNST, SBCF, SFBS, SFNC, SFST, SMBK, SPFI, SSB, STEL, TCBI, TRMK, UBSI, UCB, USCB

11. Piper Sandler will buy and sell securities on a principal basis for the following companies: FBK, HTH, SNV