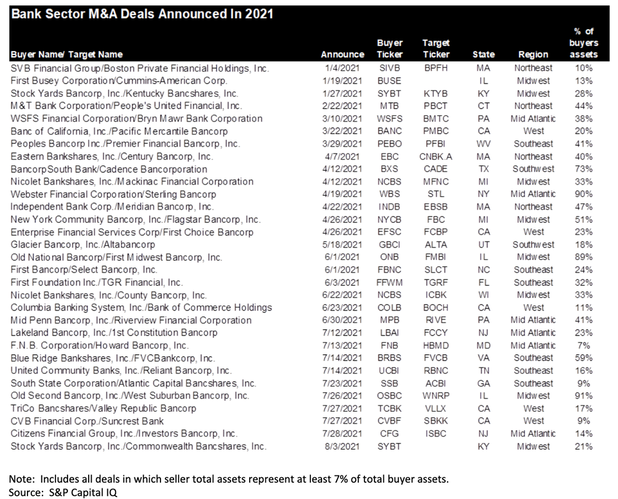

The market has cast a wary eye toward the stocks of most acquisitive banks. For several months now, we’ve noted that while we expected the pace of bank M&A to pick up meaningfully, the market’s receptiveness to it would likely be more tempered than what we’ve seen during the early recovery phase of prior cycles. Without rehashing all the details, our basic premise was that banks fared unusually well during the pandemic, helped by their own fundamental resiliency, a novel approach by the regulators to allow forbearance, and massive monetary and fiscal stimulus. As a result, the bank sector has emerged from the COVID pandemic in remarkably healthy condition, and thus, the start of this M&A wave has not been marked by sales of troubled banks at depressed pricing, as is typically the case coming off a recession. Rather, deal pricing has been more akin to what we tend to see toward the later stages of the M&A cycle, when most active acquirers underperform the broader bank index. Not surprisingly then, the market has thus far in this cycle viewed most active acquirers with a wary eye, and we suspect this isn’t likely to change for the foreseeable future.

-

- Virtually all acquirers’ tangible book value multiples have compressed from deal announcement to where they trade today. The average decline is ~3.5% and there are several deals in which the acquirers’ TBV multiple has declined in the double-digit range in percentage terms. It’s interesting to note that the decline in TBV multiples and the average decline in acquirer’s stock prices is exceeding the level of absolute TBV dilution in these transactions, which is running right around 3% on average, suggesting that the market is taking a dim view of most acquirers’ actions.

- Significant EPS accretion isn’t the determining factor in how the acquirer’s stock will perform post-announcement. The argument we hear is something along the lines of “if the projected EPS accretion is high enough, it will offset the negative perception of TBV dilution.” The data proves that isn’t the case, and we think the reason is as follows: TBV dilution is up front and certain, whereas EPS accretion is a projection of what can possibly be achieved over a longer period of time, and as such, should be appropriately discounted. The market seems to be telling us that in a post-COVID environment, the future is more uncertain than ever – no one really knows what the “new normal” is going to look like, and so the market is assigning an even higher than usual discount to future EPS projections. The pitch from the i-bankers is usually that if you meet certain thresholds for your deal (these have always seemed rather arbitrary if you think about it): <3 yr. earnback; mid to low single digit TBV dilution; mid to high single digit EPS accretion; etc., then your stock should fare reasonably well post announcement. However, if you look at the M&A data in the aggregate so far this year, on average, the typical transaction more than meets the aforementioned criteria: EPS accretion on average for deals announced so far this year is projected around 10%; TBV dilution is roughly 3%; TBV earnback is about 2.5 years. And yet, acquirers’ stocks have significantly underperformed the bank index – by nearly 6% on average in the three months post deal announcement.

- Acquirers that said their deals were immediately accretive to TBV generally didn’t perform appreciably better than those that indicated their deal would be TBV dilutive. This was perhaps the most surprising takeaway, and sort of turns conventional thinking on its head. One would think that deals that were additive to TBV would perform better in the marketplace, but that hasn’t necessarily been the case. At best, the data is inconsistent, and would seem to suggest that the absolute level of TBV dilution/accretion is not the foremost driving factor in assessing how the acquirer’s stock is likely to perform post-announcement.

- The large bank deal that has been most well-received has also been the cheapest on an absolute basis. The notable aspects of the NYB / Flagstar deal that stand out are: (1) first and foremost- the very low absolute price paid on TBV (116%), which is just about the lowest price paid by any acquirer on this list so far this year; (2) the deal seems to neatly check the other boxes; (3) nicely accretive to EPS and immediately accretive to TBV. However, other deals that were more expensively priced on an absolute basis on TBV, but still checked the other boxes, haven’t performed nearly as well. This lends further credence to the notion – expressed numerous times in our prior published content – that the absolute price paid on TBV matters, regardless of what the “deal math” would seem to suggest.

- M&A activity in this cycle isn’t likely to be a driver of valuation enhancement and stock price appreciation like it was in the early stages of the prior cycle. Looking back to the few years immediately following The Great Recession, there were several acquisitive banks that distanced themselves from the pack in terms of fundamental performance and share price appreciation. It was these companies that were among the highest valued in the banking sector. These banks traded at premium multiples coming out of the recession, quickly seized upon the opportunity to acquire failed banks at attractive pricing, and then pivoted to still-inexpensive whole bank acquisitions as market conditions improved. Deals were highly accretive, and the acquirers were high-performing companies whose fundamental performance was further enhanced. The market hadn’t yet caught on to the “accretion game”, whereby earnings derived from purchase accounting were valued similarly to core, sustainable earnings, juicing share prices even further and positioning the acquirers’ well for the next transaction. Some harbored high hopes for a repeat of that scenario as the sector emerged from the pandemic, but as noted above, these hopes were quickly dashed given the robust performance of virtually all sector participants through the downturn. In short, the M&A wave is almost certain to continue, likely picking up additional steam and potentially driving takeout prices even higher. However, it’s difficult to envision a scenario where stocks of the most active acquirers are among the sector’s better performers over the remainder of this cycle.