Did you know that a well-structured board succession plan is not just an option but a necessity for effective board governance and the future prosperity of your bank? Are you ready to adopt a strategic approach to board refreshment and succession planning? If so, look no further than the latest edition of Travillian Next’s Bank Board Insights Series.

This must-read deep dive article is the third edition of the series and offers a comprehensive analysis of the critical role that multi-year board succession planning plays in community banks. To achieve optimal performance, boards require a balanced mix of engaged directors and a strategically planned board composition that embraces a visionary process for developing a robust board.

A forward-looking board would adopt a multi-year succession planning process given the transformation in governance in today’s increasingly high-pressure business environment. The board of directors has not only a critical oversight role but a crucial role to play in shaping the future of their organization. Each board member’s voice matters.

If your board aims to position itself for the future and tackle the challenges of a highly complex and dynamic climate, this article is must-read. It offers invaluable recommendations and strategies for enhancing board governance, ensuring your board is well-equipped to deliver long-term value and future success.

Don’t miss out on this opportunity to build an optimal board. Read on for insights and advice from Greg Dufour, President and CEO of Camden National Corporation ($5.7 billion assets), Rilla Delorier, Board member of Coastal Community Bank ($3.4 billion assets) and Atlantic Union Bank ($20.1 billion assets) and Dr. Demir Yener, Professor of Finance and Corporate Governance at The Johns Hopkins University that can take your board’s governance to the next level.

The Art of Board Succession Planning and Why it Matters

Boards are not adequately addressing board refreshment and succession planning. While banks often prioritize long-term planning for CEO succession, they tend to overlook the same approach for director succession. Instead, director succession is frequently viewed as a simple task of filling vacancies, rather than as an opportunity to construct an effective and forward-thinking board. The reluctance to address this sensitive topic may be hindering the board from making decisions that are in the best interest of both the board and the banks. To address this issue, a forward-thinking board should implement a multi-year planning process recognizing the transformation in governance that is taking place.

It is crucial to have ongoing board succession planning that follows a structured process to ensure optimal board composition and performance. Director tenure and succession planning should be prioritized on the board agenda, rather than being discussed only when a retiring director needs to be replaced. Establishing clear expectations regarding board tenure and the optimal mix of board tenure levels is pivotal for developing a board that is viewed as a key strategic asset to the organization. “We are very proud of what we do at Camden National where we are constantly talking about what are the skills, talent and experience we need for a new board member not just for replacing or retiring director but in situation where we want to increase the size of the board” said Greg Dufour, President and CEO of Camden National Bank. The governance committee of the board constantly looks at it and assesses it. “If board members need cyber or tech experience and we are proactively looking at that.”

By adopting a forward-looking, multi-year planning process and adhering to a structured board succession planning process, boards can increase their odds of success in forming engaged boards capable of navigating unprecedented challenges and identifying risks and opportunities.

Beyond Filling Seats: Board Succession Planning as a Visionary Process

As the tenure of board directors draws to a close and board seats become vacant, a sound board succession plan can make all the difference in boosting your organization’s recruitment efforts. A robust board succession plan not only ensures smooth transitions but also helps in effective recruitment of new board members. By having a well-defined succession plan, boards can proactively search for candidates with the right skills, expertise, and experience required to drive the organization forward. So, investing time and resources in crafting a comprehensive board succession plan can pay rich dividends in the long run, as it provides a roadmap for the board to navigate through change and maintain continuity in leadership. President & CEO, Greg Dufour of Camden National Bank notes the importance of succession planning not only with the directorship level but also at the Chair of the various important committees that results in development plans to match that going through. If you look at what the board does is similar to what we do for succession planning for me and my direct reports. I do believe that is best practice. He recommends for any type of succession it is “deliberate but it should feel natural.”

Overall, the board should prioritize board refreshment and succession planning to ensure that the board is composed of individuals who can bring diverse perspectives, skills and experiences to the table. During bouts of market uncertainty, a solid board has the potential to tap high caliber directors with high level judgements to make tough decisions. This approach will enable the board to make informed decisions that support the long-term success of the organization.

Embrace a Futuristic Approach to Board Composition

In light of the banking turmoil, there has been an ongoing debate regarding the appropriate distribution of responsibility for organizational performance. The presence of a strong board of directors with a wide range of expertise, pertinent skills, and above all, a penchant for critical thinking, can significantly impact the constructive questioning of assumptions and decision-making in today’s high-pressure environment.” We want a balanced board. We take diversity very seriously. 40% are female directors and gender diversification is very important to us. When you look at our board we have people with large corporate experience, some business owners, people with non-profits and a former Chancellor of the University of Maine. We have been fortunate to really diversify that experience level reflecting the communities, customers and people that we have in Maine. We operate in New Hampshire as well.” The big key to that is everybody has to embrace the diversity of thought.”

According to Johns Hopkins Corporate Governance professor Demir Yener, “boards should not entrench.” He notes a reasonable tenure for a board director is around six years. Boards should ask a lot of questions and challenge perspectives.”

In the absence of proactive board of director succession planning, governance committees may face difficulties in finding suitable replacements for outgoing directors. This could result in a diversion of directors’ energies and attention from other important organizational priorities, leading to a potential loss of confidence in the board’s management abilities among investors and stakeholders.

These challenges can be effectively avoided by implementing a sound succession plan, which enables boards to recruit more efficiently as director terms expire and vacancies arise.

The Keys to a Successful Board Transformation

Crafting a sound succession plan for the board not only minimizes the risk of disruption caused by unexpected departures but also opens doors for fresh and innovative perspectives. It facilitates seamless leadership transitions, anticipates future leadership needs, and enhances the board’s diversity profile. “We have a working list going on all the time through internal efforts and we may have gaps. How do we fill those gaps to get exposure to the talent that could mean looking outside to recruiting firms or outside centers of influence that would fill the skill, talent and experience.” said Greg Dufour. Besides, it enables regular assessment of the board’s performance, identification, and resolution of skill gaps while ensuring new board members are in sync with organizational objectives which guarantees optimal outcomes. “The hardest part of a CEO and the board is simultaneously balancing the need to perform in the short term and generate shareholder value. At the same time, you are investing in transformation for the future, that is future proofing the company” said Rilla Delorier, a board member of Coastal Community Bank and Atlantic Union Bank. “What I found is often the skills needed for transformation and skills needed to drive near term performance, also the way you measure risk and set goals and willingness to take risk are different in the two aspects of the business” acknowledges Rilla Delorier.

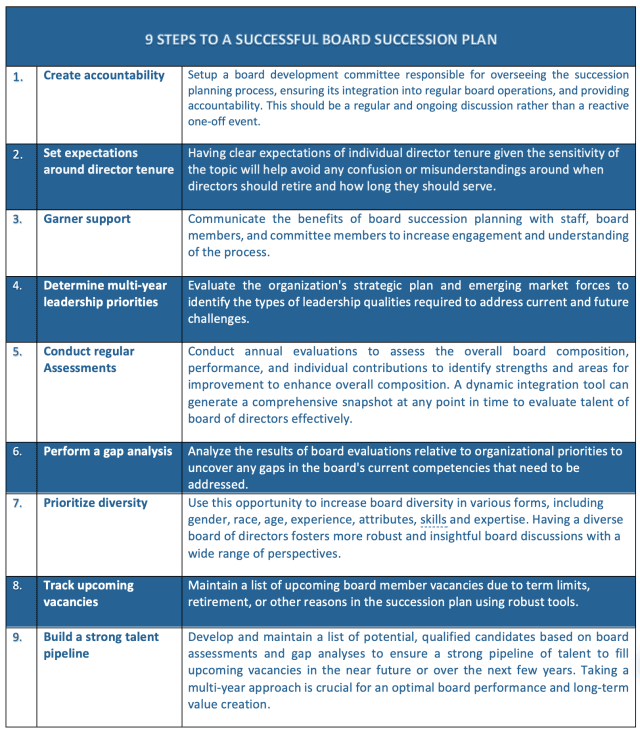

The nine essential steps to develop an effective Board Succession Planning that ensures optimal board performance.

Unlock Optimal Board Governance Potential: The Crucial Role of Assessments

Annual board evaluations are a critical aspect of good governance, but often lack the rigor and objectivity expected by stakeholders. Recent trends include broader disclosure, more frequent assessments of individual directors, and third-party facilitators to provide an unbiased view of the board’s performance. Don’t just “check the box” with board assessments – go beyond that to uncover real value. Greg Dufour notes “annual assessment of the board gives the chair the feedback and evaluates performance of the board and the chair.” To maximize the benefits, it’s important to avoid viewing the exercise as just compliance and instead adopt rigorous evaluation, tough and candid feedback and follow-up with a measured target. An example is setting 12-month targets based on top three key priorities with evaluation of quality boardroom discussions and contributions. The days of a passive director role are long gone as building an engaged board is crucial for the long-term success of the bank. A specialist in digital transformation expertise may be with a younger profile lacking the relevant banking expertise. A board must have a balanced mix of diversified skill-set, mature judgement that comes from experienced directors and younger directors that may offer expertise on certain specialized needs of the bank. Assessments are a crucial foundation for the future of your board and help develop priorities that enhance governance performance and practices. Whether it’s an annual board assessment, committee assessment or individual director assessment, the process yields actionable results for continuously improving board performance. “Giving peer feedback makes me better and it makes us better. It can be hard to critique your peers but if we make it safe and create an environment it can take the board to a whole new level.” observes Rilla Delorier.

Level Up Your Board Engagement

Greg Dufour says “One interesting thing that our chair has done is with a new board member he assigns an existing board member as a mentor. It helps not only with professional development but also personal development as it is an introduction to our board. I would recommend all boards to do that as it has worked out extremely well for us.”

Rilla Delorier notes, “Having a culture of engagement in the board or really wanting to wrestle with issues from multiple perspectives by having healthy debates in recognizing issues are complex and multiple perspectives have to be taken into account to make the best decisions.” According to Rilla Delorier, “Board debates are minimized for efficiency to get through the agenda but board debate is really where the best decisions get made.”

Professor Demir Yener observes, “Directors with strong industry background does not necessarily mean they are effective. Training through workshops and seminars is crucial in developing the board of directors.” Professor Demir Yener further notes there are five types of directors that include passive, certifying, engaged, intervening, and operating. He notes an engaged board member is what a board needs to effectively add value to the executive team.

Board Refreshment

As the governance landscape has progressed, the significance of board composition has also undergone a transformation. Given that a small number of board members bear the weight of overseeing crucial matters, each seat holds immense importance. Investors and stakeholders are keen to ensure that the board consists of exceptionally skilled directors who, collectively, bring a diverse range of experiences and backgrounds to effectively govern the company. Camden National Bank recently approved to declassify the term of the board where each director will be up for re-election on an annual basis after the transition period in 2025. “This is the best practice within board governance. It is a sign of accountability” according to Greg Dufour. Greg Dufour acknowledges that “I want to have directors that myself and executive team look up to and initially says I can learn something from you. You have a different experience and I want to use you as a resource for that and that sets a high bar because I have a talented executive team.” He further notes that “What I look for in a director is for somebody who I can look up to for their guidance, advice, and their judgement. Sort of a mentor. That is how we found the good people that we have. You need that relationship going in day one.” The subject of board composition is receiving increased scrutiny and holds greater significance in the present era of evolving governance. “We don’t have term limits. We feel 72 age requirement fits into that and today that is a relatively low retirement age. That keeps enough into the term to refresh our board.” According to Greg Dufour, “Regardless of term limits or tenure what I look for is engagement of the director. We offer board educational opportunities both internally and externally. Then we look to how engaged is our board in taking advantage of those opportunities. Are they doing that to keep pace with the change we are going through.” said Greg Dufour. The responsibility entrusted to each board member carries considerable weight in today’s changing governance landscape. Additionally, Greg Dufour noted that “we have a relatively small board. The smallness forces everybody to be highly engaged and open to different ideas and thoughts, not getting entrenched. “There is no risk of entrenchment”.

Board Succession Planning Not Optional

Your board’s present strategic governance actions are driven by a well-structured, multi-year board succession planning that is actively evaluated and measured. An absence of such planning results in a reactive narrative that limits your board’s optimal performance. A random evolution of board composition without a structured multi-year succession plan leads to myopic decision-making, ultimately compromising the effectiveness of your board.

To stay ahead of the curve and tackle any unforeseen obstacles, bank boards must be proactive in pondering over their board composition on a continuous basis, rather than only when a director bids adieu. This strategic approach can guarantee optimal performance and equip boards with the necessary tools to overcome any hurdles that come their way.

Key Takeaways for Effective Board Governance with Board Succession Planning

A tactical and reactive narrative to board composition limits optimal board governance potential and performance.

Do you have a well-crafted multi-year board succession planning that follows the nine essential steps?

The right mix of board of directors diversified by skills, expertise, diverse background, relevant experience, and age can constructively challenge management with in-depth and critical thinking and hold accountable.

Do you adopt a visionary process to board composition and successions planning as a board is a key strategic asset to your bank?

Evaluation of the whole board, committee, and individual directors with specific top talent KPIs is crucial to future success.

Do you evaluate and measure board, committee, and individual directors with specific key priorities annually using robust and dynamic tools?

A widely adopted approach to address concerns of director entrenchment and board stagnation has been the shift from classified to declassified boards, where directors are elected on an annual basis. This transition aims to prevent director entrenchment and ensure that boards remain dynamic rather than stagnant.

Do you have a board refreshment protocol that prevents board entrenchment and keeps boards from becoming stagnant?

Interested in more? Read Part I or Part II of our Bank Board Insights Series.

Travillian’s Banking and FinTech Practice provides Search and Talent Advisory services to depository institutions across the country. Established in 1998, the firm has built a unique platform that touches every corner of the industry. To learn more, click here, or get in touch below!

|

Indra Elangovan, Head of Strategic Advisory

(443) 844-2798 | ielangovan@travillaingroup.com |