“History never repeats itself, but it does often rhyme.” -Mark Twain

It’s been a rough couple of years for Fintech and many Fintech-affiliated banks. Valuations for pure Fintech companies peaked in late 2021 and have since plummeted. While the circumstances are different, in retrospect, it’s clear that historically low-interest rates, unprecedented monetary and fiscal stimulus, and COVID precautions which furthered the advance of technology combined to drive a speculative frenzy reminiscent of the early 2000’s “dot-com” bubble. This manic period came to a screeching halt in early 2022 as inflation accelerated and interest rates rose rapidly over the next 18 months, culminating in a banking liquidity crisis sparked by the failure of three tech-oriented banks — Silvergate Bank, Silicon Valley Bank, and Signature Bank – in March 2023.

On the one hand, these are facts that are beyond dispute. But a closer examination of fundamental trends and stock price performance reveals that it would be a mistake to characterize all “tech banks” with the same broad brush. Consider the following:

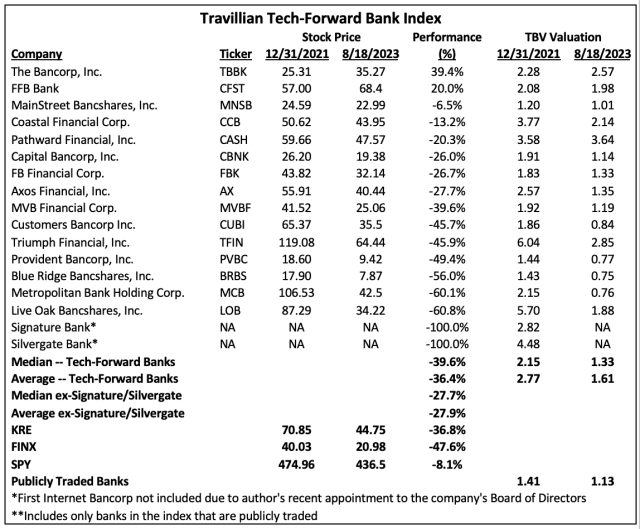

– Tech-forward bank stocks as a group have performed roughly in line with the broader bank stock index. If at the start of 2022, we had allocated $100 to each bank stock in the Travillian Tech-Forward Bank Index – including to the two banks, Silvergate and Signature, that have since failed (Silicon Valley Bank was not in the index due to its larger size), resulting in a 100% loss of investment – the aggregate investment in tech-forward bank stocks would have lost 39.6% on a median basis, and 36.4% on average. Interestingly, the bank stock index (KRE) over that same period has declined by 36.8%, almost exactly in line with the aggregate performance of the tech-forward banks. Excluding the two failed banks, the remainder of the group has, on average, significantly outperformed the broader sector’s stock performance, down 27.9% on average.

– Several of these stocks have been notable winners. Nearly one-third of the tech-forward group has meaningfully outperformed the broader sector, led by The Bancorp, Inc. (TBBK), up just over 39% since the start of 2022, followed by FFB Bank (CFST), which has increased by 20%. Surprisingly to us, the one-third of stocks that have significantly outperformed are characterized by a diverse array of business models, areas of special tech expertise, and a wide range of measurement points on valuation. In other words, it’s not as though the least expensive stocks have performed the best, or say, companies that specialized in a certain area of fintech, like BaaS or payments.

On the flip side, however, we can point to some commonalities among the stocks that have performed worst. For instance, the two banks on the list that failed as well as two others that have struggled mightily were those most intently focused on crypto, which was subject to cataclysmic pricing declines and increased regulatory scrutiny. Rounding out this group of the worst-performing stocks are others that have dealt with serious regulatory challenges, and the two stocks that were most expensive at the initial measurement point (LOB and TFIN). While both of the latter two stocks continue to trade at healthy premium valuations (to other tech-forward bank stocks as well as the broader bank sector), they simply had further to fall given the elevated starting point (roughly 6x TBV).

– Tech-forward bank stocks, on average, continue to trade at a meaningful premium to the broader sector. While the magnitude of the premium is certainly reduced from what it was, tech-forward bank stocks continue to trade at a premium valuation to the sector at large. Indeed, the 17 tech-forward bank stocks at the initial measurement point traded on average at 2.77x tangible book value, compared to the broader bank sector average at the time of 1.41x. Moreover, only one tech-forward bank stock at the time traded at a significant discount to the bank sector average. Today, there is far more dispersion in valuation among the tech-forward bank group, but on average, this group in the aggregate continues to trade at a significant premium to the broader bank sector average. Tech-forward bank stocks today trade on average at 1.61x versus the sector average of 1.13x, though about one-third of these tech-forward bank stocks currently trade below the sector average, which means that the premium for the tech-forward group in the aggregate is increasingly driven by a few select companies, whereas previously, virtually the entire group traded at a significant premium.

Price performance over the measurement period is obviously dependent in part on valuation considerations, which, as we noted earlier, is why the best performing group of stocks represents a diverse array of business models and fintech specialization. However, looking at it through a different lens, towards current valuation levels, it’s clear that the market is valuing more highly certain business models. For instance, of the stocks currently trading at roughly 2x TBV or higher, four of the five (TBBK, CFST, CASH, TFIN) operate significant payments-oriented businesses, which are less sensitive to the macro factors and other issues, including interest rates, inflation, and liquidity, that have proven challenging to navigate through this cycle. This isn’t to take anything away from these companies; quite the contrary: credit to them for constructing a business model that’s proven more resilient through difficult times. We’ll look forward in the future to diving deeper into these business models to better understand and articulate the success these companies continue to enjoy.

No repeat, but certainly some rhymes. In many ways this post-bubble “shakeout” period for Fintech continues to resemble the period immediately following the implosion of the “dot-com” boom as well as prior boom/bust periods, implying that there is a roadmap as to how things may play out from here. Revolutionary technologies almost invariably are subject to periods of speculative excess, after which there is a “shakeout” followed by the emergence of a few notable winners, some of whom weren’t even yet in existence during the initial period of speculative mania (Google/Meta, as an example, among others, were formed post the “dot-com” boom). The shakeout period is also typically characterized by doubts about the long-term viability of the technological advancement that drove the initial boom, hence the current skepticism and soured sentiment on just about anything Fintech-related.

That said, there is more to this post-bubble landscape to consider than what immediately meets the eye. The convergence of banking and technology continues apace, in our view, and will only intensify in the years ahead, providing a nearly unprecedented growth opportunity for those with the longer-term staying power, foresight, and wherewithal to capitalize. In the nearer-term, volatility will undoubtedly persist, with market interest rates now exceeding prior cycle highs, the path of inflation uncertain, liquidity still challenged, and recessionary signals unclear.

In the coming months, we’ll continue our chronicling of this post-bubble shakeout period, with a deeper dive into the business models that have proved more resilient through these challenging times. Stay tuned!

Joe Fenech is the Managing Principal of SMBT Consulting, LLC, which provides consulting services to banks. The article represents the views and beliefs of Mr. Fenech and does not purport to be complete. The information in this article is provided to you as of the dates indicated and the data and facts presented herein may change. You should not rely on this article as the basis upon which to make an investment decision; this article is not intended to provide, and should not be relied upon for, tax, legal, accounting or investment advice. Mr. Fenech is also the Chief Investment Officer and Managing Member of GenOpp Capital Management LLC, an investment adviser that maintains exempt reporting status in the State of Indiana. Affiliates of SMBT Consulting, LLC may recommend to such affiliates’ clients the purchase or sale of securities of companies discussed in articles published by SMBT Consulting, LLC.