It’s been clear for some time now that Tech-Forward banks are seperating from the pack…

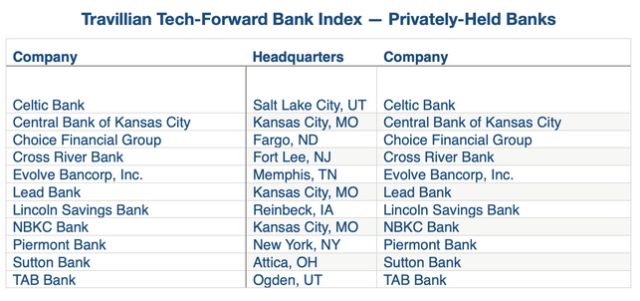

The Travillian Tech-Forward Bank Index was created last year to help identify a select subset of the bank sector that we felt was at the forefront of the convergence of traditional banking and fintech. Each company that was selected benefitted from “first-mover” advantage in their early embrace of technological change and were among the leaders in their area of fintech expertise. Results-to-date evidenced strategic ingenuity, and for many of these companies, financial outperformance in certain key metrics, top quartile profitability, and a premium stock valuation. For others, while there is undeniable evidence that a successful strategic pivot is underway, it hasn’t yet materialized in the form of financial gain of stock market recognition. The common thread underlying our selections, however, was that strategic priorities, fundamental performance, share price performance, and stock valuations would likely continue to diverge from traditional bank peers in the coming years, which we thought was a compelling reason to track progress of this group as its own niche within the bank sector.

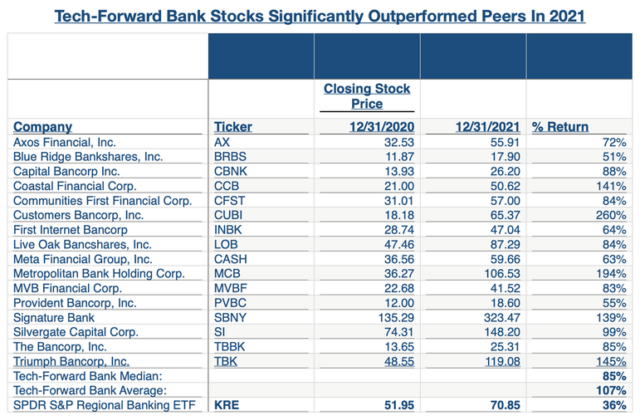

…the outperformance of these stocks relative to their traditional bank peers in 2021 was staggering and no one was left behind.

That said, we didn’t anticipate how quickly it would all come together. Bank stocks as a group were among the top-performing sectors of the stock market in 2021 – indeed, the SPDR S&P Regional Banking ETF (“KRE”) was up 36% for the year. However, tech-forward bank stocks performed appreciably better. Specifically, the 16 publicly-traded tech-forward banks on our list were up 107% on average – roughly 3x the KRE – while it’s also worth noting that each of the 16 stocks was up by more than 50%.

What we also found interesting was that these tech-forward bank stocks performed extremely well across the valuation spectrum, suggesting that it was the tech-forward theme, rather than some unifying valuation-based commonality, that drove the outperformance. In other words, tech-forward bank stocks that were heavily discounted heading into the year, and others that already traded at significant premiums, all performed very well.

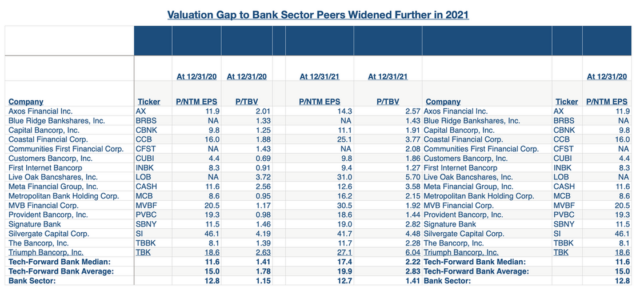

For the group in the aggregate, the valuation gap between tech-forward banks and traditional bank peers also widened further in 2021. Heading into the year, tech-forward banks already traded at a sizeable premium to traditional bank peers, at 1.78x TBV vs. 1.15x TBV, respectively, however, this premium expanded further by year-end, to 2.83x TBV on average, compared to 1.41x for the bank sector at large. Similarly, on a forward P/E basis, tech-forward banks ended the year trading at a five multiple P/E advantage, on average, compared to just over a two multiple advantage heading into the year.

We see several drivers of the share price outperformance…

We think most industry observers would agree that the perception of a bank’s role as a leader in their tech specialty – whether it be payments, BaaS, crypto, digital banking, online gaming, or a combination of the above – is the one commonality underlying tech-forward bank stock outperformance in 2021. But there are several other drivers as well, in our view, which could further expand the valuation gap to traditional bank peers.

- First, and most simply, we’ve noticed anecdotally (from speaking to the companies) and “on paper” (though ownership filings) an influx of pure tech-focused investors moving more aggressively into this tech-focused bank niche. These investors are seemingly less constrained by the traditional valuation methodology typically utilized by dedicated bank stock investors. Moreover, weakness in publicly traded fintech and large swaths of the technology sector in 2021 led many of these investors to seek the stability and strong foundational balance sheet and earnings profile of the regulated banking system without having to sacrifice their growth mandate. In other words, an investor could buy a tech-forward bank with exponential top line growth potential, and in the process, leave behind the future uncertainty associated with certain pure fintech business models and pending regulatory changes. “Since the start of the pandemic, several tech investors that we hadn’t previously met have sought us out for meetings,” said Eric Sprink, President and CEO of Coastal Financial Corp. “In fact, at some investor conferences, meeting requests from technology-focused investors outnumbered those from bank investors”.

- Second, there is a segment of the “old school” bank stock investor group that seemed to embrace the growth potential of these tech-forward banks while at the same time, slowly gained comfort with the risk profile of these institutions. As a bank sector observer for over two decades, our experience has been that robust growth by banks is typically followed by a hard fall – the playbook is usually the same: bank grows commercial real estate aggressively outside of its footprint, attracts a cult-like investor following during a period of benign asset quality, posts superior profitability metrics during its period of rapid growth, only to then implode spectacularly during the next economic downturn as loan quality soured. We remember quite vividly a study conducted in the aftermath of the Great Recession which concluded that of the ten best-performing banks with the highest concentration of construction and development loans during the 2005-2007 period, seven of them ultimately failed during the financial crisis. Given that history, one could forgive the traditional bank stock investor for viewing the current growth wave with a skeptical eye. There are admittedly aspects of this “tech-driven lending boom” – with its enabling of nationwide, out-of-footprint lending, in some instances reminiscent of the reckless lending of old simply under different packaging – that deserve the “old school” bank investor’s wary eye. However, we should also keep in mind that entire new industries have formed, and these tech-forward banks are in many cases at the forefront in providing the infrastructure needed to build out these industries with seemingly limitless growth potential. Bottom line, certain of these banks have been presented with an opportunity that could produce sustained growth in excess of what is typically associated with banks (which we think of as modestly exceeding the pace of GDP growth within their markets), without the typical risk factors that come with robust growth through the economic cycle. If that proves to be the case over time – as it has appeared to be over the past couple of years — then a new paradigm for valuing tech-forward banks will emerge to challenge the long-held notions of traditional bank stock valuation analysis. Our sense is that the early stages of a “breakout” from the traditional paradigm is what we witnessed in the performance of these tech-forward bank stocks in 2021.

- Third, and building on the prior point, these growth opportunities are seemingly less tied to the traditional economic and interest rate cycle as compared to growth opportunities of the past. Historically, banks attract low-cost deposits during periods of low interest rates, only to see those deposits flow out as rates rise and betas increase. On the lending side, growth can be sustainable for a few years, but typically not through economic cycles. For those reasons, investors have tended to discount explosive growth exhibited by banks. While the jury is still out on this growth cycle, we think investors began to apply more of a full growth-sector multiple to tech-forward banks last year. The possibility that robust growth in segments like crypto and online gaming, for example, may prove more durable through the economic and interest rate cycle, with perhaps less credit risk attached to both the infrastructure buildout of these industries and particularly the low-cost deposit growth.

- Finally, investors could also be moving towards tech-forward banks as a defensive maneuver (but that also represents a tremendous growth opportunity), willing to pay higher prices for banks that are taking decisive action to combat the challenges facing their traditional bank peers. “There is an undeniable, accelerating migration of traditional banking needs into the digital space,” said Brian K. Plum, President and Chief Executive Officer at Blue Ridge Bankshares, Inc. “We see the growing movement of small business and commercial banking services, deposits and lending, into embedded finance platforms. PPP accelerated business borrowers’ comfort levels with digital lending, and the next decade will be to small business lending what the first two decades of this century were to consumer lending. Banks needs to adapt, and must do so deliberately and quickly.”

…as well as indications that it could continue for the foreseeable future.

Another differentiating aspect of these banks is how quickly they evolve and adapt to changing market conditions, a characteristic that should continue to serve them well, against a backdrop of change at a pace never before seen. Larry Mazza, President and CEO of MVB Financial Corp., noted that “in 2021 we completed our MVB 3.0 three-year strategic plan. We made progress in laying out our tech-forward road map and exceeded our performance goals. In 2022, we are rolling out our new three-year plan, called MVB F1, and we believe we are in the pole position to drive NII, NIB, and especially EPS to new levels.”

Looking ahead, we think market conditions could be ripe for a continuation of the recent trend, at least for the foreseeable future. Interest rates remain on the rise, which bodes well for banks in general, and particularly for tech-forward banks that are driving growth on both sides of the balance sheet at a robust pace. That said, banks are still viewed as a value play, with the vast majority likely benefitting from a shift in money flows from growth to value, should the macro thesis of higher long-term interest rates coupled with a Fed on the move on the short end, play out as expected. At the same time, “growthier” segments of the market, likely including tech and fintech (particularly those that are less profitable with weaker balance sheets), could struggle. This could lead pure tech investors to look toward the tech-forward bank niche again, while traditional bank stock investors become increasingly more comfortable with the sustainability of growth and new valuation paradigms that emerge to analyze these tech-forward banks. The risk of course is that interest rates rise to a level at which credit concerns would emerge, particularly against the backdrop of a likely slowing economy, but we see that as a question for another day.